On the weekend, the Liberal party announced two new policies around housing and superannuation in the lead up to next week’s election. The first was lowering the age threshold for those who could access downsizing contributions to superannuation.

The second was a ‘Super Home Buyer Scheme’, which would allow Australians to borrow up to 40% of superannuation to purchase their first home (capped at up to $50,000). What we know so far of these proposals is outlined below.

What were the measures outlined?

Expanding downsizing contributions to over 55’s

Australians over 65 years of age can currently make a once-off contribution of up to $300,000 into superannuation from the sale of the family home (for a couple, this contribution is up to $300,000 per person). The $300,000 is not counted as a part of superannuation contribution caps, is an after-tax contribution, and can even be made on the sale of a property that is no longer a principle place of residence.

The main benefits touted for older Australians is to give a quick boost to their superannuation balance, while incentivising downsizing. This would theoretically release more established housing supply for younger families.

From July 2022, the federal government had previously proposed to lower the age threshold to 60. Now, the change will be enacted for those over 55. This would qualify up to 1.3 million households to be eligible for the scheme. However, the scheme came into effect in 2018, and only around 22,000 had utilised it between July 2018 and May 2021.

In addition, the party announced a re-elected liberal government would extend the time that these proceeds would be exempt from the pension asset test, up to two years. This change would commence from January 2023.

The Super Home Buyer Scheme

The second was the announcement of the Super Home Buyer Scheme. This would allow first homebuyers to invest up to 40% of their superannuation (to a maximum of $50,000), to purchase their first home. Eligibility criteria for the scheme includes:

- Available only to first homebuyers who have separately saved at least a 5% deposit;

- Available to first homebuyers of any income;

- Each person in a couple may access the scheme if they are eligible;

- Applies to both new and existing homes; and

- Applies to any property price.

Under the scheme, the money and any share of capital gain or loss must be returned to the superannuation fund once the property is sold. It would start 1 July 2023.

The recent ‘Retirement Income Review’ from the Australian Treasury noted the home “is the most important component to voluntary savings” and housing is considered a major determinant of retirement outcomes. Further to this, voluntary savings (including housing) is considered to be one of the three pillars of the retirement income system, along with the age pension and compulsory superannuation.

Considering the importance of housing as a contributor to lower housing costs, greater financial independence and higher living standards at retirement, the government’s policy to utilise a portion of superannuation to enable home ownership has some merit when considering housing as an investment in one’s future. In fact, allowing first home buyers to utilise superannuation as security for a home loan was one of the key recommendations within the Inquiry into housing affordability and supply released earlier this year by the House of Representatives Standing Committee on Tax and Revenue.

This policy announcement goes beyond the recommendation from the inquiry, which was limited to utilising superannuation as a form of collateral, rather than as a deposit. There is provision within the policy that any funds taken from superannuation, along with proportional capital gains, must repatriated to the superannuation fund at the time of selling the property. This will help to safeguard the primary aim of superannuation: saving for retirement.

However, there are some downsides with relation to stimulating more housing demand and creating inequities with regards to accessing home ownership for lower income households who may not have accrued a sizeable level of superannuation savings.

The impact of demand side policies

Allowing first homebuyers to access superannuation for their upfront housing costs on a broad basis will add to demand, and this could increase the cost of housing. This may be good news for homeowners looking to protect their wealth, or sellers in an environment where housing market conditions are starting to soften, but for first homebuyers it could erode some of the benefit of dipping into their super.

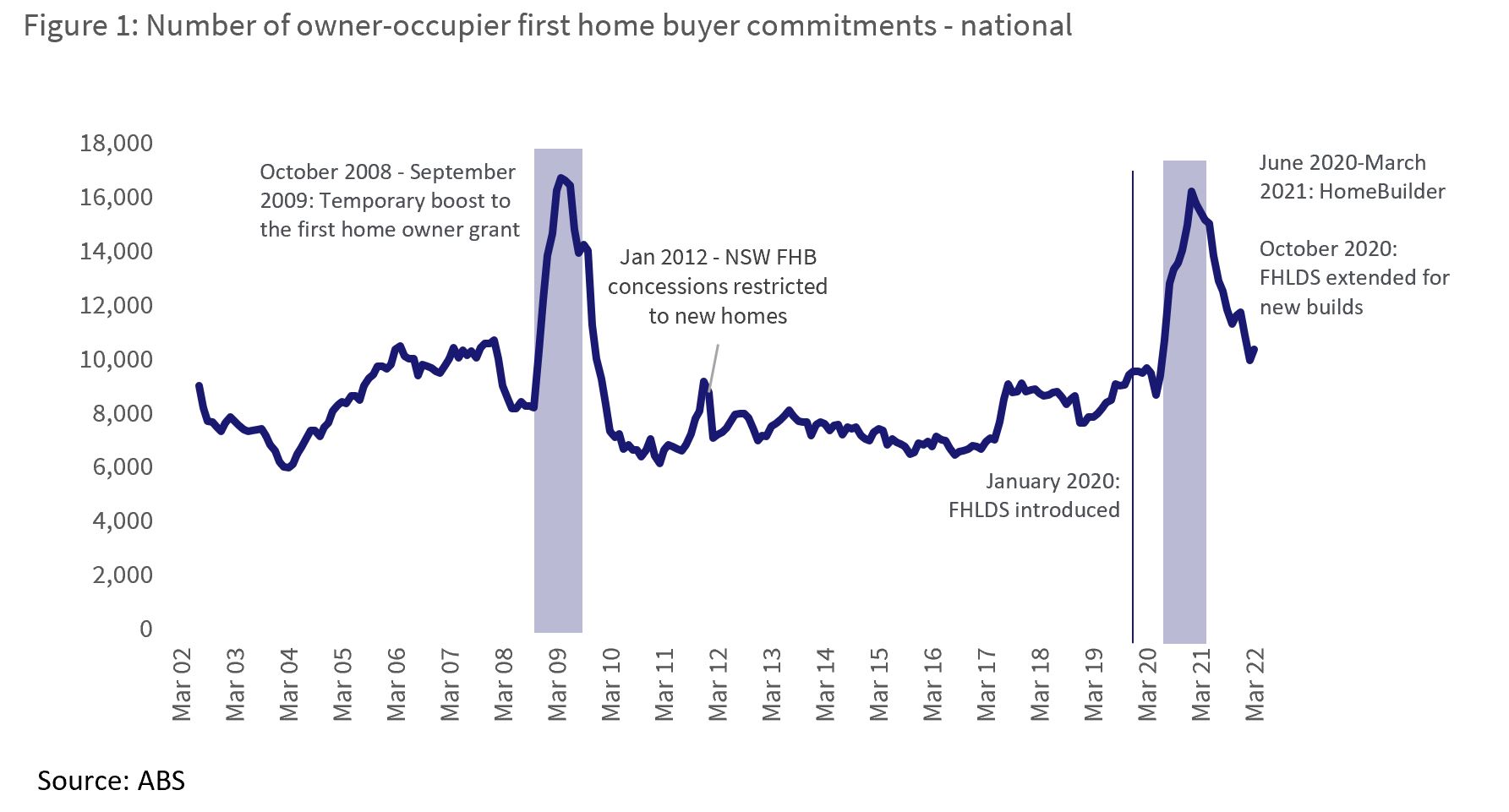

Historically, first home buyer activity has been elevated when first homebuyer schemes are enacted. Admittedly the effect seems most concentrated when the schemes are temporary, and interest rates are low. This can be seen in figure 1, which shows the monthly national loans secured for first homebuyers over time. Temporary, demand-side first homebuyer incentives coincide with a surge in demand.

For an ongoing scheme, like the First Home Loan Deposit Scheme (FHLDS), homebuyer grants or the proposed LNP home equity scheme, first homebuyer demand may not be as concentrated under the Super First Home Buyer Scheme. It is also worth noting first homebuyer demand may have been brought forward through homebuilder, low interest rates and the FHLDS, which may further reduce demand-side shock from the Super Home Buyer Scheme.

However, there is a clear desire for Australians to use superannuation for housing costs, which was anecdotally reported during the coronavirus pandemic, where people experiencing hardship could withdraw up to $20,000 from super.

Furthermore, it is a very challenging time to be incentivising more housing demand in the face of supply-side constraints. Housing construction costs have risen significantly, adding to the cost and timeline of new builds.

No income caps make this scheme inequitable

The actual value that could be accessed through this scheme is relatively low for the typical young first homebuyer. According to ABS data, the median superannuation balance in Australia was around $55,000 at June 2020. First homebuyers are typically younger, and the median super balance was just $25,000 for those aged between 25 and 34 years of age. At 40%, the scheme would offer just $10,000 at the median level, or the equivalent of some state-based first homeowner grants. CoreLogic data shows the current median dwelling value in Australia is $748,635, meaning the scheme could help increase the size of a standard deposit by around 1 percentage point.

Australia does not just have a housing affordability problem, but a housing equality problem. Grattan research has shown over the decades that poorer Australians have seen the biggest declines in rates of home ownership, which becomes a problem when home ownership is then the difference between a comfortable retirement, and a retirement of poverty. For home ownership to play such a significant role in our financial futures, it should be more equally accessible.

Those who would be able to withdraw up to $50,000 would have superannuation balances of $125,000. Unlike the first home loan deposit scheme, or Labor’s proposed shared equity scheme, there are no income caps associated with the Super Home Buyer Scheme, making it far more advantageous for young first homebuyers on higher incomes.