New data from the Australian Prudential Regulator Authority (APRA) shows banks and lenders took a more conservative approach to housing lending in the December quarter of 2022.

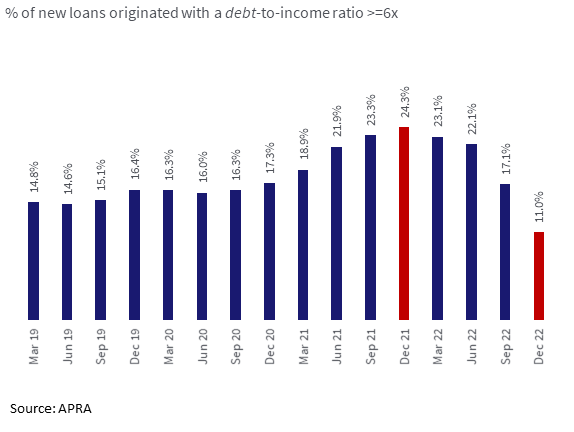

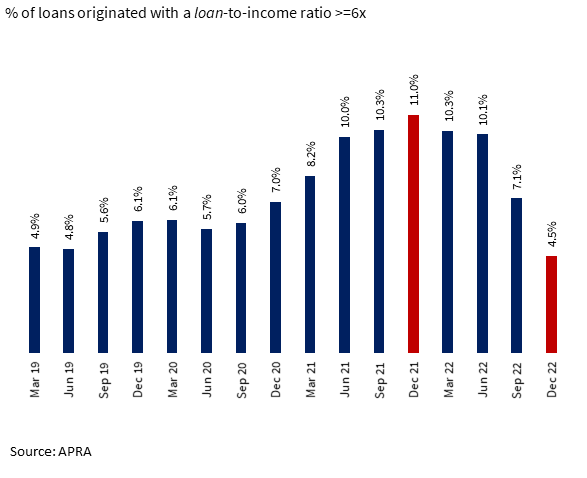

The Quarterly ADI statistics report reveals the portion of new loans originated on a debt-to-income ratio of six or more dropped to just 11.0% in the quarter, after peaking at 24.3% a year earlier. The portion of new loans originated with a loan-to-income ratio of six or more also dropped to 4.5% from 11.0% a year earlier.

The sharp drop-off in lending at high debt-to-income ratios, and loan-to-income ratios coincides with the bulk of the current rate hiking cycle flowing through to prospective borrowers, which has limited borrowing capacity. Both of these ratios represent record lows, though on a relatively short back series to March 2019.

The portion of new loans on interest-only terms also declined, though by a smaller margin, to 19.0% of loans originated in the quarter. This is down from 19.3% in the previous quarter, with historic lending data suggesting a much higher peak (upwards of 40% in the mid-2010s).

The portion of loans originated with a loan-to-valuation ratio of 90% or more (i.e. a deposit of 10% or less) declined to a record low 5.9%, down from 6.2% in the previous quarter. This included a decline across both the owner-occupier segment (to 7.7%) and the investor segment (to 2.3%).

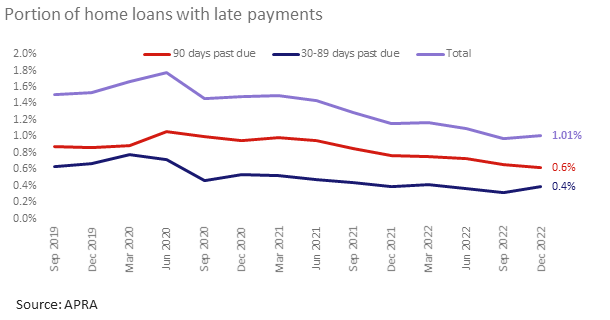

The APRA publication also reports on the volume of housing loans that are non-performing (or 90-plus days past due), as well as loans where payments are late by 30-89 days. In the December quarter of 2022, the total portion of loans with late repayments sat near record lows of 1.01%. This increased from 0.98% in the previous quarter, led by a slight uptick in the volume of loans that were 30-89 days past due (from 0.3% to 0.4%).

The slight uptick in loans past-due may be an early indicator of some households struggling to keep up to date with their mortgage repayments amid rising rates and high cost of living expenses. As more households see fixed terms expire, and further rate increases loosen labour market conditions, we are likely to see the portion of loans with late payments trending higher in the coming quarters, albeit from record lows.

However, the labour market is expected to remain tight by historic standards, even if the unemployment rate rises over the course of the year. It is also worth considering the adaptive and resilient nature of households. There are still 99% of mortgage borrowers who continued to make timely payments in the December quarter against sharp increases in the cash rate, with most outstanding lending on variable terms. As interest rates continue to rise, more households will likely divert money from savings to interest payments.

Overall, the latest APRA data points to ongoing stability in Australia’s mortgage market, as well as a more prudent lending environment as interest rates rise.