Demand for housing nationally has surged amid record-low interest rates, fewer people per household and delays in new housing completions.

For Brisbane and Greater Queensland, a record year of internal migration to the state in 2021 has exacerbated competition for housing. Property values have climbed 38.1% since the onset of COVID-19 in March 2020, and rents increased 23.0% in the same period.

Amid the rising housing costs, low income renters are particularly vulnerable to experiencing homelessness. According to AHURI research, a tight housing market is one of many factors that increase the risk of losing secure housing. Using five key charts, we unpack just how tight the Brisbane rental market has become in 2022.

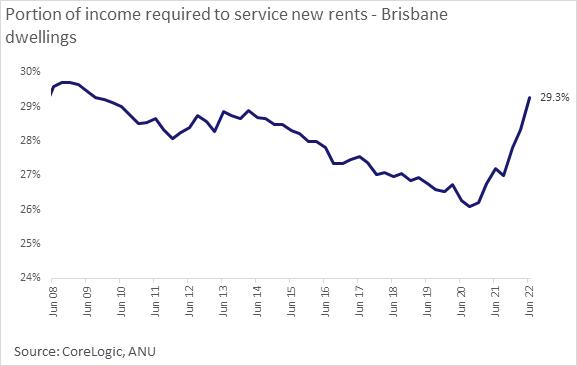

The portion of income to service a new lease in Brisbane has reached its highest level since 2009

The portion of median household income required to service a new rental lease across Brisbane reached 29.3% in June 2022. This data, compiled by CoreLogic and ANU, compares median dwelling rents with the median estimate of household income in the area. This measure of housing affordability had generally been improving since a construction boom across Brisbane in the early 2010s. However, this dynamic has been changing since the September quarter of 2020, with the portion of income to service new rents reaching its highest level since 2009.

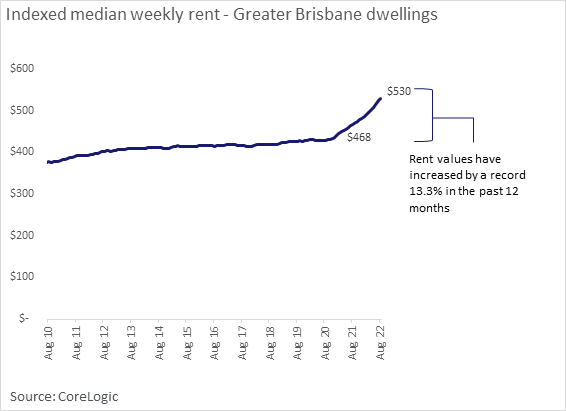

The median rent value across Greater Brisbane is $530 per week

CoreLogic calculates median rent valuations for homes across Australia. For Greater Brisbane, the median weekly rent value at the end of August across all dwellings is $530 per week. Indexing this median by historic growth in rents, weekly values across Greater Brisbane have increased a record 13.3% from around $468 in August last year.

The rental vacancy rate in Greater Brisbane is trending near record lows

The monthly rental vacancy rate across Greater Brisbane was recorded at 1.0% in August. This is less than half the five-year average of 2.8%. The rental vacancy rate measures the portion of vacant, available rental properties in a region. In July, CoreLogic estimates the rental vacancy rate hit a record low of 0.9%.

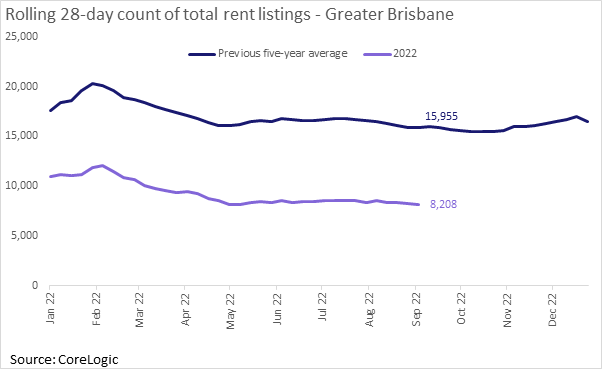

Total rent listings are 48% lower in 2022 than the previous five-year average

CoreLogic counted 8,208 advertised rentals across the Brisbane market in the 28 days to September 4th. This is -48.2% lower than the previous five-year average for this time of year. The limited available rental stock has created stiff competition for rental accommodation, which has contributed to higher rental costs.

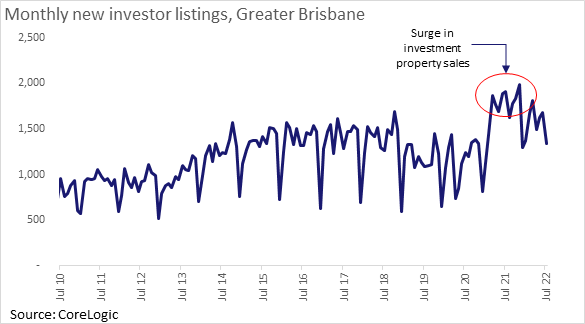

Investors ‘sold up’ as housing values peaked

The chart below shows ‘for sale’ listings added to the market on a monthly basis across Greater Brisbane that were last advertised for rent within the past eight years. This is a proxy for newly advertised listings of investment properties. The chart indicates a surge in investment property sales through 2021, which may have contributed to a shortage in rental supply.

It is worth noting that if investors sell to first home buyers, this can actually alleviate some of the demand pressure in the rental market, as people transition from renting to home ownership. However, if these investment properties are sold to households who are not first home buyers, for example, people purchasing a second home interstate, then there is less chance of a relief in rental demand.