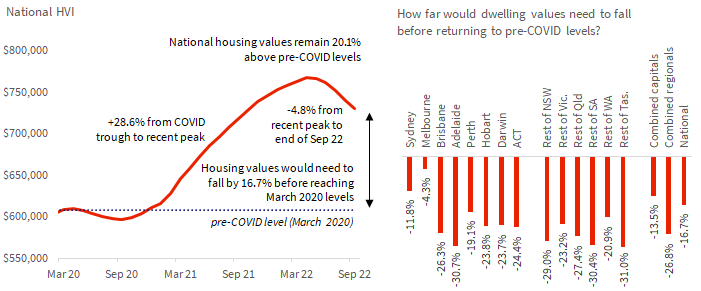

With the recent growth phase well behind us across most regions of the country, attention is squarely focused on how much housing values could fall before levelling out.

After CoreLogic’s national Home Value Index (HVI) surged nearly 29% through the recent growth phase, the full extent of how far housing values will fall remains highly uncertain and largely dependent on the trajectory of interest rates.

Since the national monthly HVI peaked in April, dwelling values are down 4.8% to the end of September, ranging from a 9.0% fall from peak in Sydney, to Darwin, where home values remain at a cyclical high.

Mainstream forecasts for a peak to trough decline also vary remarkably, but generally range from around 15% to 25% across the combined capital cities. For context;

- a 15% drop from the peak in April 2022 would take CoreLogic's combined capital cities index back to roughly March 2021 levels.

- a 20% drop in values would see the index 2.2% lower than the onset of the pandemic in March 2020.

- a 25% drop in capital city dwelling values would take the index 8.3% below March 2020 levels; a similar reading to August 2016.

The risk of housing values returning to pre-COVID levels varies from region to region.

Across the capital cities, arguably Melbourne’s housing market is most vulnerable; a further 4.3% slide in dwelling values would take Australia’s second largest city back to March 2020 levels.

This vulnerability isn’t due to housing prices falling faster than other cities, in fact Melbourne’s quarterly rate of decline, at -3.7% through the September quarter, was a milder rate of decline compared with Sydney (-6.7%), Brisbane (-4.3%), Hobart (-4.5%) and Canberra (-4.4%). Melbourne simply didn’t see as much growth in values through the upswing, with a 17.3% rise from the COVID trough to peak. This comparatively modest rise in values means Melbourne home values don’t need to fall as far as other capitals before wiping out all of its COVID gains.

At the other end of the spectrum, Adelaide’s housing values surged through the growth phase and, since peaking in July, have held reasonably firm. The market would need to drop by almost 31% before values in the City of Churches returned to pre-COVID levels.

Regional markets are also looking relatively secure from wiping out their COVID gains. The combined regionals index would need to see values fall a further 26.8% before reaching March 2020 levels.

Across the broad rest-of-state regions, Regional Tasmania has the largest buffer, with housing values needing to plummet 31.0% before reaching March 2020 levels.

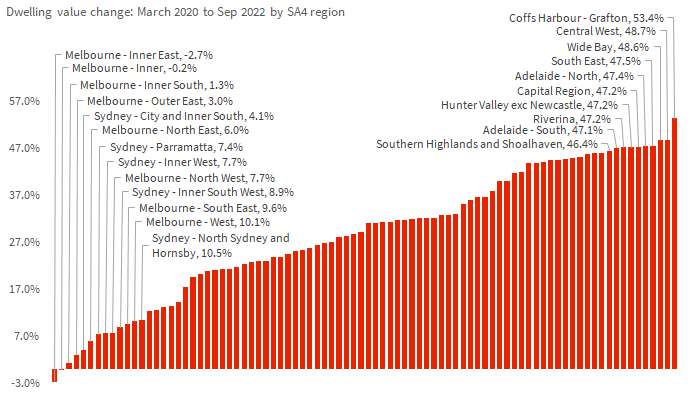

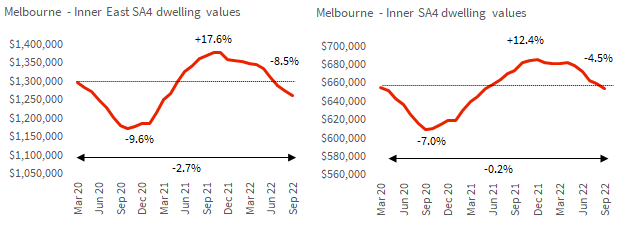

CoreLogic’s analysis of Australia’s 86 SA4 regions reveals housing values in only two areas were trending below pre-pandemic levels by the end of September 2022: Melbourne’s Inner East (-2.7% relative to March 2020) and Melbourne Inner (-0.2%). The drop to below pre-COVID levels in these two regions is mostly due to a larger downturn in housing values through the early stages of the pandemic, along with a milder upswing relative to most other capital city regions. Both markets are now moving through a downturn, with housing values across the Inner East of Melbourne down 8.5% since peaking in November last year, while Melbourne Inner values are down 4.5%.

Dwelling values across 77% (66) of the 86 SA4 regions analysed nationally remain at least 20% above pre-COVID levels at the end of September 2022. These regions were mostly concentrated in Regional NSW (12), followed by Brisbane (9), Regional Queensland (8) and Regional Victoria (8).

The large portion of regions around the country that retain a sizeable valuation buffer is a reminder that housing values would need to fall substantially further before the entirety of COVID gains were wiped out.

The trajectory of housing values is very much dependent on where, and when, interest rates land. Cash rate forecasts from the Big 4 banking economic units range from 2.85% through to 3.6%, while (at the time of writing) financial markets were pricing in a 3.9% cash rate by August next year. Clearly there remains a great deal of uncertainty around where and when monetary policy and housing values will stabilise.