Normally at this time of the year the number of fresh listings is moving through a dramatic seasonal upswing, however early indicators suggest the flow of new listings are starting relatively softly.

After a lackluster listings season through spring and early summer last year, vendors still seem to be reluctant to test the housing market at the start of 2023. The flow of new listings over the past four weeks was 25.9% below the previous five-year average and 20.3% lower than the same period a year ago.

Total advertised supply was tracking well below average levels through the final quarter of 2022, and has started the year with the number of properties listed for sale 31.5% below the previous five-year average and 2.9% lower than at the same time last year.

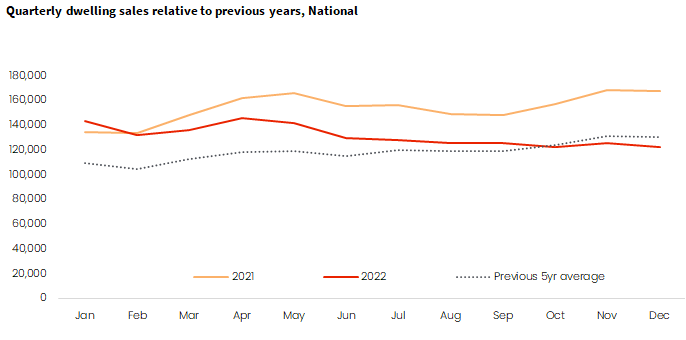

The shortage of new listings comes at a time of below average demand. Through the December quarter last year, the number of home sales was estimated to be 27.3% lower than at the same time in 2021 and 6.6% below the previous five-year average. If a normal, or above average number of properties were being added to the market amid a slower rate of absorption we would have seen total advertised stock levels rising, which could amplify price falls.

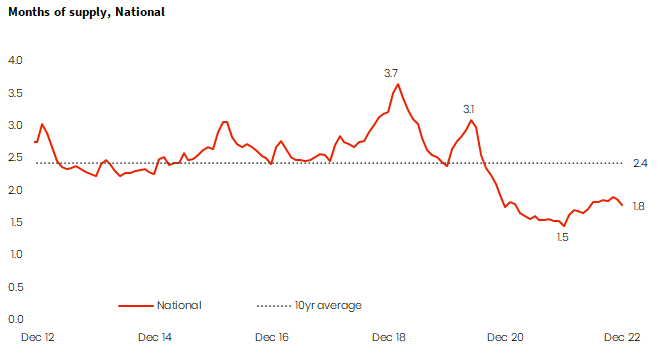

Combining the total count of listing and run rate of sales through the December quarter last year provides a reasonable measure of the balance between available supply (total listings) and demonstrated demand (volume of home sales). Months of supply (i.e. how long would it take to absorb all advertised stock based on the current run rate of sale) continued to hold well below average at 1.8 months, and substantially lower than recent housing downturns where months of supply was as high as 3.7.

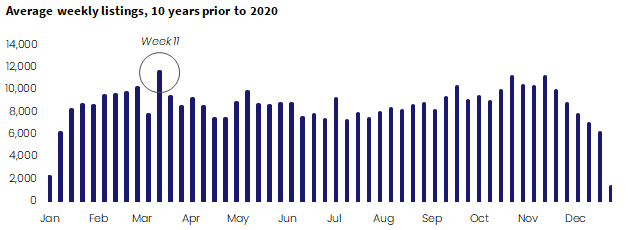

Will we see a seasonal ramp up in fresh listings?

New listings normally increase significantly in late January through to late March, with a second wind in the weeks leading up to Easter. Based on the pre-COVID decade average, ‘week eleven’, roughly mid-March, has typically represented the seasonal peak in the flow of new listings activity nationally.

Early indicators are pointing to a continuation in the relatively mild flow of new listings to the market, at least over the coming weeks. Pre-listing activity by real estate agents across CoreLogic’s RP Data platform is -15.3% lower over the first 22 days of the month compared with the same period a year ago, suggesting vendors remain wary of listing their property while market conditions tend to favour the buyer.

While it’s too early in the year to assess the likelihood of a pre-Easter bump in listings, ‘week 11’ will be an important test for the market. Arguably there will be some pent-up supply that has built up through the second half of 2022 from prospective vendors who have been holding off selling until market conditions improve.

A ramp up in new listings at a time when buyer activity is likely to remain below average could see total advertised supply levels rise, providing more choice for those buyers who are active, and potentially creating some additional downwards pressure on housing prices.

A buyer’s market

While advertised stock levels remain low, it is clear housing market conditions have ‘turned’ to favour buyers over sellers. Based on homes sold by private treaty through the December quarter, properties were on the market longer (averaging 31 days across the capital cities and 41 days in regional Australia) and in order to sell their property, vendors applied larger discounts to their initial asking prices.

Auction markets have also weakened with the combined capital cities clearance rate finishing the year at 51.9%, well below the decade average of 65.1%.

Buyers are no longer facing a sense of urgency to make a purchase decision and they can negotiate on price more aggressively. If they don’t secure a price they think reflects good value, they can simply move on to the next property amid persistently declining prices.

Vendors, on the other hand, need to be realistic when setting their price expectations, be prepared to negotiate and ensure they have a high-quality marketing campaign behind the property.