In this article, Head of Research Eliza Owen examines the performance of the rental market in Australia.

CoreLogic’s national median rent value ticked up to $601 per week last month, equating to median annual rent of $31,252 a year.

CoreLogic median rent is based on a current estimate of rent income, describing what the median dwelling in Australia would rent for if you put it on the market at any given time. The $601 median is a series high, and coincides with total annual rent increases of 8.3% nationally.

The median has increased markedly from $437 per week in August 2020, pushing annual rent values up by more than $8,000 in that time.

How did we get here?

Recent growth in rent values, which averaged 9.1% a year for the past three calendar years, stands in stark contrast to the average annual growth rate of 2.0% in the 2010s. Since the onset of the pandemic several factors have contributed to unusually large rent rises, including:

- A notable decline in the average household size from late 2020, partly driven by a reduction in share housing – meaning more dwellings were needed even when population growth was close to zero in 2021.

- A rapid increase in the Australian population from late-2022 as international border restrictions were lifted.

- A temporary shock to investment housing activity between May 2022 and February 2023 as interest rates rose. Investor activity has picked up markedly since, but there is still a lot of catch up required in establishing new rentals.

Longer term factors have also increased demand for rentals.

The reduction in social housing supply as a portion of all dwellings over the decades has placed more pressure on the private rental market, as has a declining rate of home ownership. Average household size has also been gradually declining over decades due to economic and demographic factors (for example, more people living alone), requiring more dwellings to house a given population.

Rent value increases have broadly outpaced wage and income rises at the national level, meaning rental affordability has also deteriorated. The portion of gross median household income required to service median rent rose from 26.7% of income in March 2020 to 31.0% in September last year. While a far higher portion of median income is required to service a new mortgage, renters tend to be on lower incomes. The latest data from the ABS suggests median gross household income was 41.8% lower across renting households than owner occupiers with a mortgage.

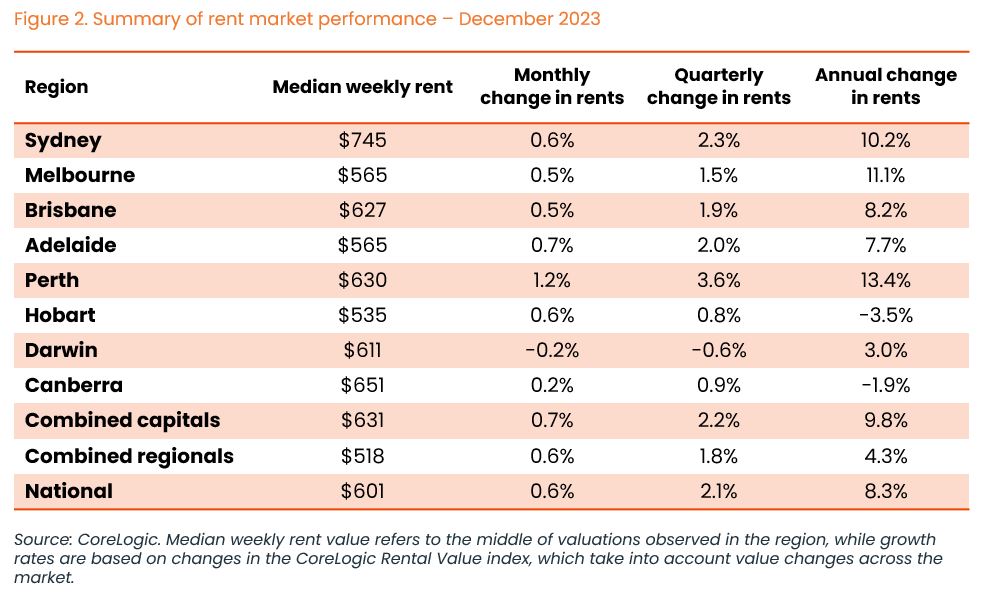

Median rents across the capital city markets ranged from $745 per week in Sydney, to $535 per week in Hobart. Canberra and Hobart were the only markets to see a decline in rent values through 2023, at -1.9% and -3.5% respectively.

Of 88 SA4 dwelling markets analysed (see Figure 3 on page 3), only 16 were down from historic highs. This ranged from the New England and North West market of regional NSW, which has fallen marginally from a peak in the previous month, to the Outback North of WA, where values are still 25.6% below the peak achieved amid the 2010s resources boom. Despite being well below its historic peak, the Outback North of WA had a relatively strong uplift in rent values over the past year, at 11.1%.

Across the SA4 rental markets, the highest median weekly rent was in Sydney’s Northern Beaches ($1,167 per week), followed by the Eastern Suburbs ($1,046). The lowest median weekly rent across the capital city SA4 markets was the Melbourne – West market.

Rent growth is starting to slow…

While annual growth in rents is higher than historic averages, it has broadly slowed. In 2023, rent values rose 8.3%, down from a peak of 9.6% in the year to September 2022. The slowdown has been most evident across regional Australia, where rents rose 4.3% last year, down from a 13.4% in the year to August 2021. The slowdown in capital city rent growth began more recently, easing from a peak of 10.6% in the 12 months to April 2023, to 9.8% by the end of the year (figure 4).

As noted in previous research, growth in the CoreLogic rent value index tends to be a leading indicator of CPI rents. This is because CoreLogic rent measures are derived from advertised rents, where CPI measures rents actually paid by households. Rents paid tend to be ‘sticker’ than values, due to periodic leases (usually 12 months). Figure 5 shows the rolling annual change in capital city rent values versus the CPI rent measure. Historically the lag between CoreLogic and CPI rent measures has averaged six quarters, but already the monthly CPI rent indicator has shown a decline from 7.6% in September, to 7.1% at the end of November.

The slowdown in rent growth may be attributed to affordability constraints driving renters back to share housing, or to cheaper markets. Additionally, the recent resurgence in investor activity through 2023 may be gradually helping to ease supply-side constraints.

… but increases are speeding up again in capital city house markets

The easing in rent growth is good news with regard to inflation, but there was a slight pick-up in annual growth once again in the final quarter of 2023. This ‘re-acceleration’ in rents was most consistent across the capital city house markets, but was also evident in regional rent markets.

As noted in previous quarters, part of the explanation for an uptick in house rent growth may be in part due to households re-grouping into share houses. Additionally, the premium of house rents over units has narrowed in the past two years, from $63 per week at the median level to $38. This ‘catch up’ in unit rents could be making them less appealing, diverting tenants back to houses.

Part of the explanation could also be compositional: more affordable rental markets, such as regional or outer-suburban markets, are typically higher in detached houses. For example, some of the largest increases in annual rent growth towards the end of 2023 were house markets in Sydney’s Outer South West and the Blue Mountains. In Perth, the North West house market saw the biggest pick-up in annual growth.

Despite the concerning reacceleration toward the end of 2023, rent growth is still expected to slow this year. The continued increase in investment lending, a normalisation in net overseas migration and the potential for a cash rate reduction could all contribute to a slowdown. However, in the short term, the burden largely remains on tenants to secure cheaper housing, whether that be by re-forming share house arrangements, or once again looking to regional or outer suburban markets for rental accommodation.

Download this article with SA4 data