In today's Pulse, Eliza Owen examines the ABS's housing finance data, analysing the first home buyer segment's accessibility to the property market.

Australia’s housing market has become harder for first home buyers to access over time. The past two decades saw an increase of around 150% in the CoreLogic Home Value Index nationally, compared with an 82% rise in the ABS Wage Price Index. As a result, the wealth of property owners looking to buy their next home is likely to have increased faster than a prospective first buyer can accumulate savings. This is reflected in falling rates of home ownership, a deterioration in affordability metrics and an increase in the average age of first home buyers over time.

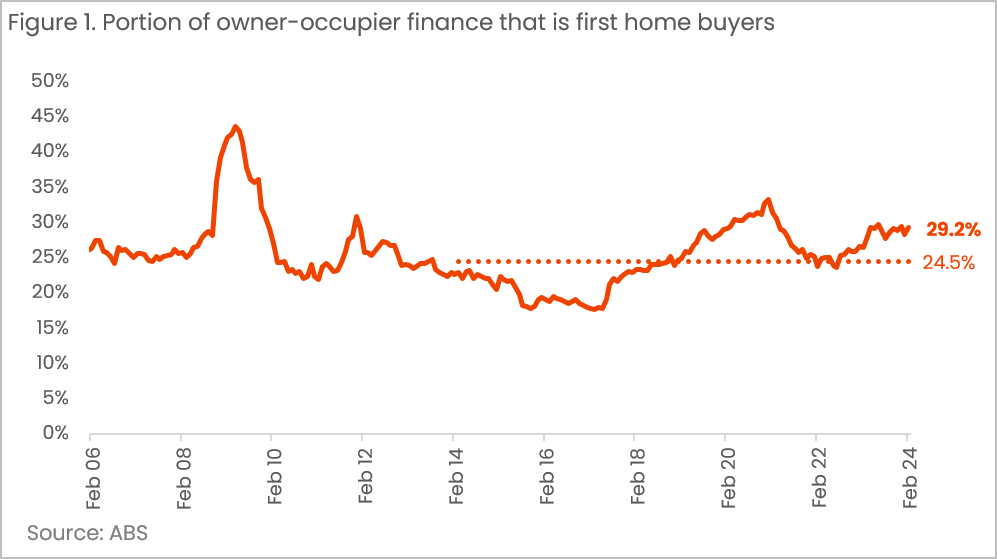

However, one data set seemingly paints a different picture. The ABS ‘lending indicators’ data includes a monthly update on the number, and combined value, of loans secured for first home purchases. The total value of first home buyer finance secured in February was over $4.9 billion, rising 4.8% over the month in seasonally adjusted terms. Despite high interest rates, a cost of living crisis, low consumer sentiment and a sharp reduction in the household saving rate, first home buyer finance and has been growing as a share of all owner-occupied finance secured since August 2022, reaching 29.2%, and rising above the decade average (figure 1).

Does this mean first home buyers are finding it easier to buy property? Not necessarily. Importantly, figure 1 is a share of all owner-occupied finance. The figure can go up if first home buyer finance is increasing, but it can also go up if non-first home buyer finance is growing at a slower rate or is falling.

The increase in the share of first home buyer finance has been exacerbated by relatively mild growth in non-first home buyer owner occupier finance. The past 12 months has seen the value of first home buyer lending rise by 20.7%, outpacing the annual growth in non-first home buyer owner occupier lending (5.0%) four-fold.

Non-first home buyers include upgraders and movers, but they also include downsizers who may not need to take out a mortgage for their next purchase, especially after the windfall capital gains seen in the majority of Australian housing markets post-COVID.

This means that relying only on the housing finance data does not paint the full picture of competition for first home buyers.

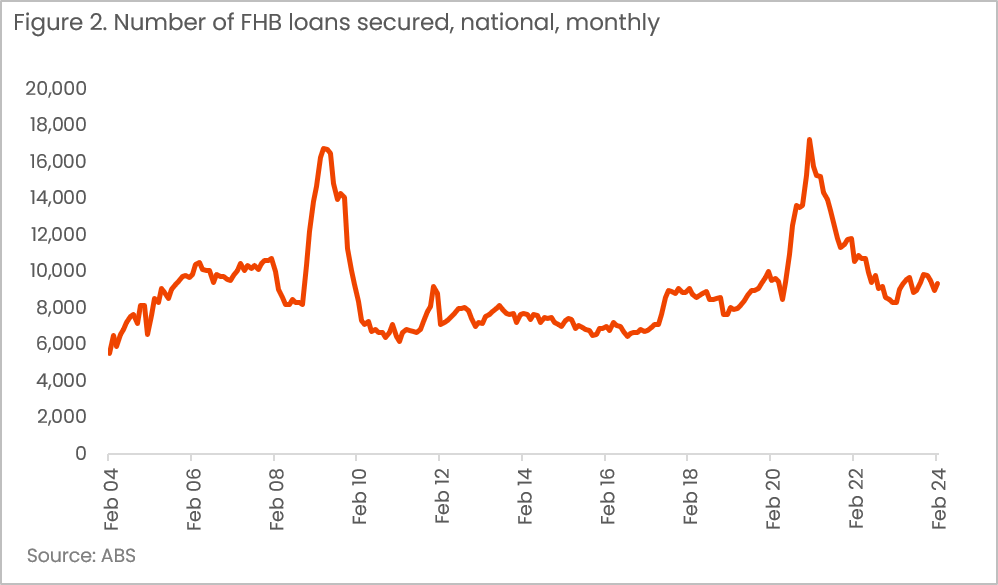

We also need to consider the number of first home buyer loans secured, because the overall increase in the value of finance can be a function of higher home values. Average loan sizes for all owner occupiers in Australia rose 2.5% in the year to February, so this could have played at least a modest part in the increase of first home buyer finance secured in the past 12 months. The monthly number of first home buyer loans secured is presented in figure 2, and recent months show the number of loans is actually well below the recent, record high in 2021.

In fact, the series shows only two substantial spikes in first home buyer loans between 2008-09 and 2020-21. These can largely be explained by temporary government incentives for housing purchases.

There was a temporary boost to the first home owner grant introduced around the GFC, and a temporary HomeBuilder grant introduced around the onset of the pandemic (which was not specifically targeted at first home buyers, but could be used in combination with the then recently introduced ‘First Home Loan Deposit Scheme’).

These grants seem to have a temporary effect on first home buyer numbers, and may just bring forward demand for those that could have bought into the market at a later date. Temporary grants for housing purchases can be used to boost economic activity when there are global demand shocks (such as a major recession, credit crunch or a pandemic), and the increased first home buyer numbers also look good for the government of the day. But the concentrated demand that happens alongside these schemes does not necessarily benefit first home buyers from a price perspective, and may also contribute to higher home values and a more competitive market.

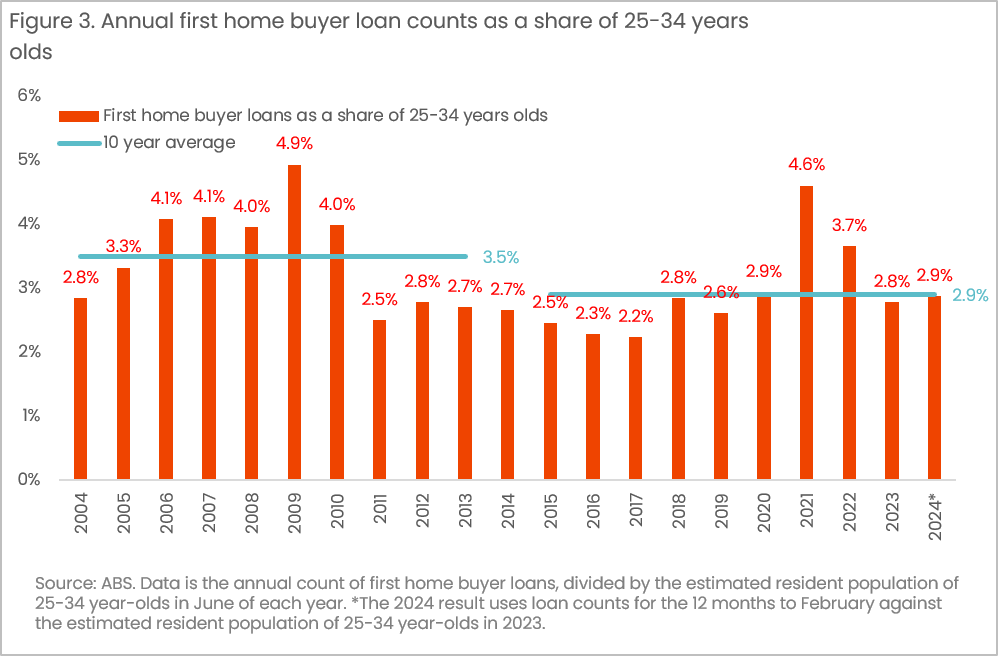

Outside these two periods, monthly first home buyer loans secured have remained fairly stable. This is also true when considering population increases. As a portion of 25-34-year-olds in Australia (which is the most common age cohort for first home purchases), first home buyer loans over time have actually fallen slightly in the past decade, but have improved a little in the past few years (figure 3).

The takeaway is that while monthly housing finance data is useful in understanding the composition of the mortgage pool, and observing the effect of temporary grants and concessions on housing loans, it does not tell us the whole story of first home buyer activity. It is useful to compare these figures with insights like home ownership rates by age and income, which are currently reported on a less frequent basis, and also to consider loan number to first home buyers with respect to the population size.