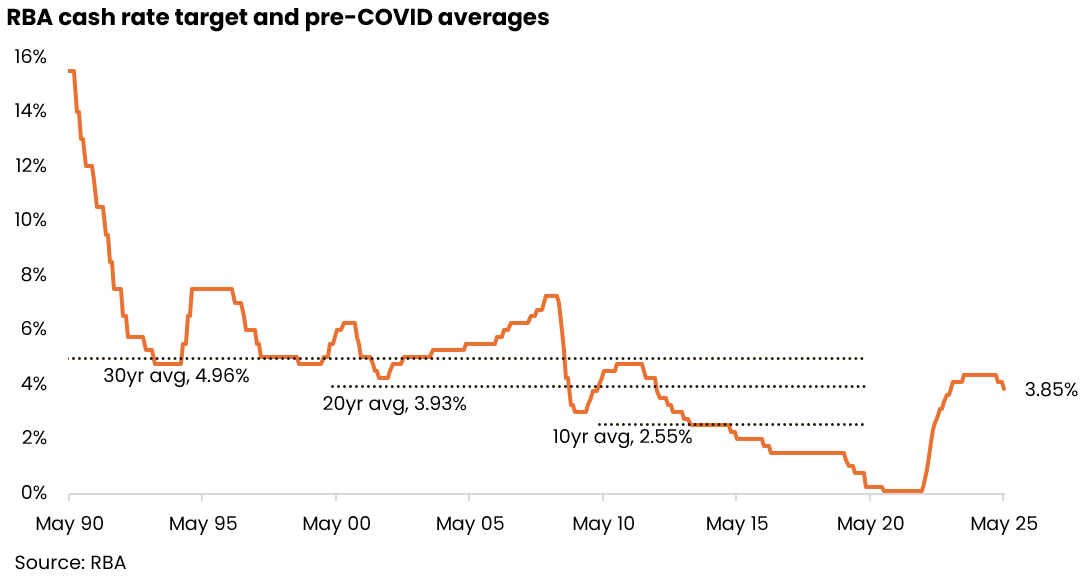

Today’s 25 basis point cut to the cash rate marks a further shift toward more accommodative monetary policy.

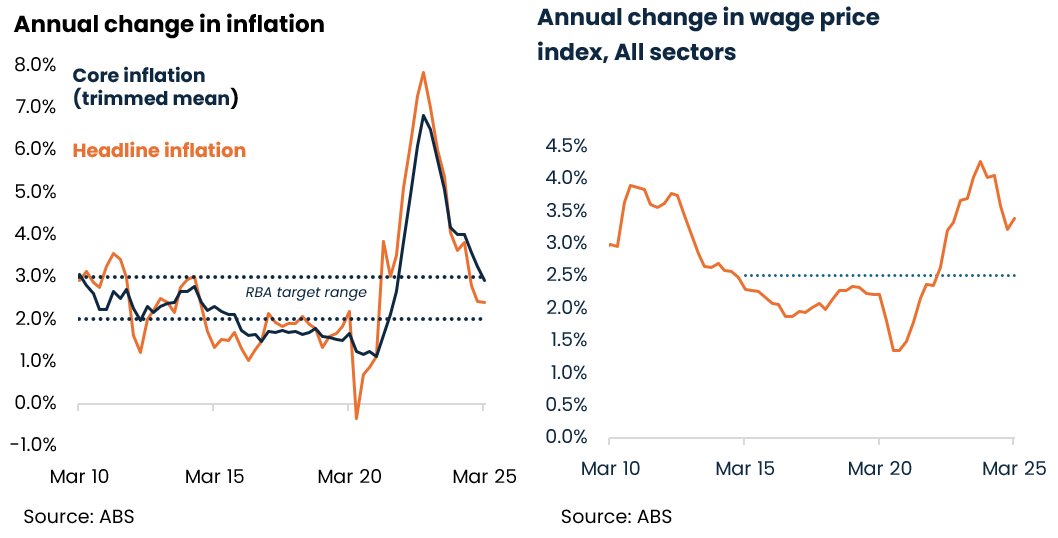

With both headline and core inflation now within the RBA’s 2–3% target range — and no signs of a wage-price breakout despite ongoing tightness in the labour market — the RBA’s decision to lower rates for the second time in three meetings was widely expected.

Borrowers are likely to benefit from this move through lower mortgage rates. The average variable rate for outstanding owner-occupier loans is expected to fall to around 5.81%, reducing repayments on a $750,000 loan by approximately $81/month.

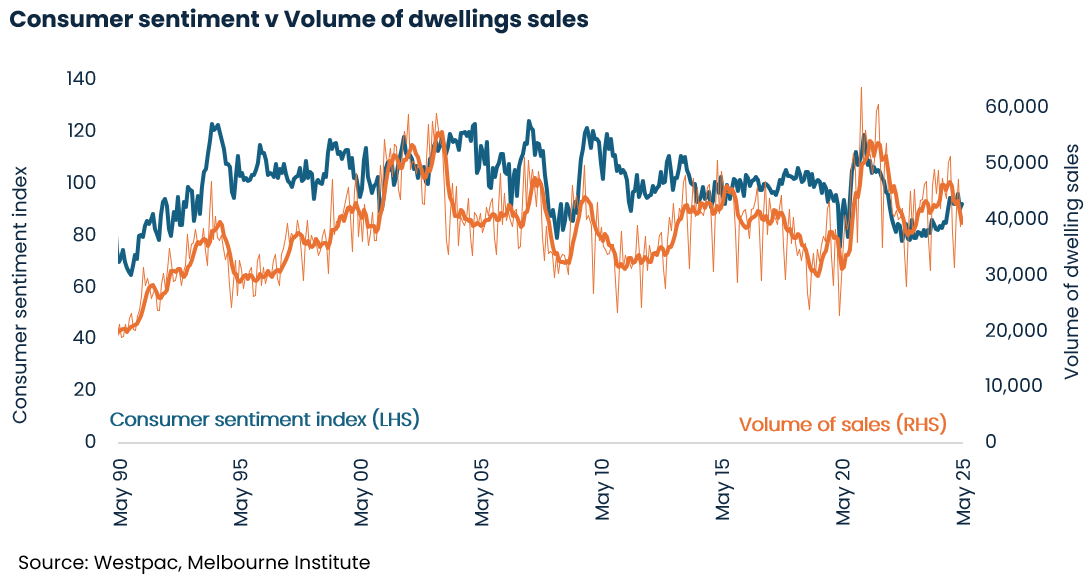

Beyond the immediate financial relief, the rate cut is also expected to lift consumer confidence. While the Westpac–Melbourne Institute monthly sentiment index has shown some volatility — particularly following the Liberation Day tariff announcements — historically rate cuts have tended to boost sentiment.

This combination of lower interest rates and improved sentiment is likely to support increased activity in the housing sector, given that there is generally a correlation between consumer sentiment and home sales volumes. We may also see continued upward pressure on housing prices, extending the broad-based recovery in values that began after the February rate cut.

That said, we don’t expect a significant acceleration in capital gains. Several factors continue to constrain price growth, including stretched affordability, cautious lending practices, and the reality that despite 50 basis points of easing, interest rates remain in restrictive territory.

While lower rates should help to make housing more accessible, further upward pressure on prices would offset the benefits of improved loan serviceability. Each of the four housing affordability metrics published by Cotality were either at record highs or equal record highs at the end of last year, a reminder of the challenges many prospective home buyers face.