Overview

The implications of climate change-induced coastal erosion on Australian properties are real and direct.

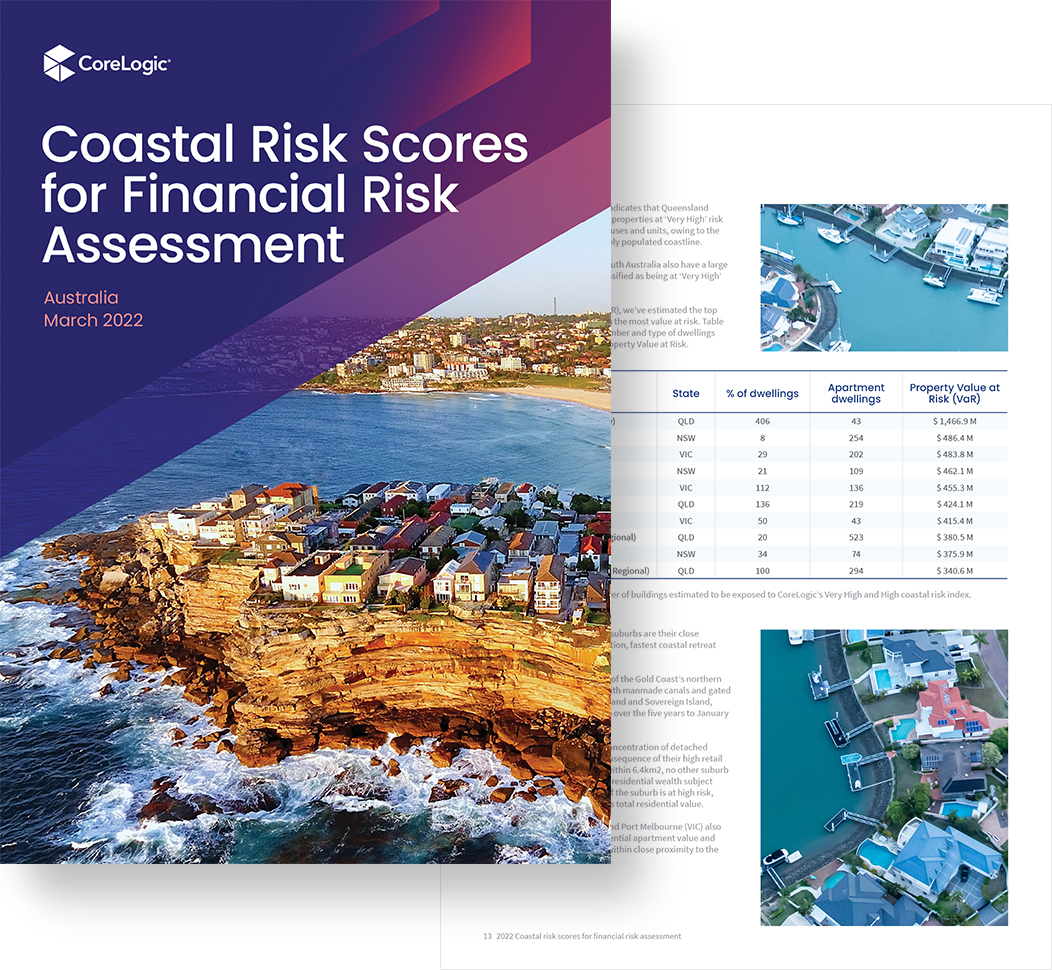

That’s why CoreLogic has developed a coastal risk score to help lenders and insurers better understand the impact coastal erosion will have on property values, as well as the flow on effects for lending policies, portfolios and insurance premiums.

As a leading provider of property data and analytics, CoreLogic has been assessing the potential impact of climate-related risks on properties vulnerable to coastal erosion. Coastal Risk Scores for Financial Risk Assessment takes a closer look at the impact of climate change on specific coastal locations, and individual properties, over time.

Download the paper

What is included?

Quantifying Australia’s Coastal Risk

Learn more about the impact of climate change on specific locations over time – and the flow-on effects for housing demand and values.

Coastal Risk Scoring

Find out how CoreLogic’s Coastal Risk Score combines coastal risk types to create a No Risk, Low Risk, Medium Risk, High Risk and Very High Risk scoring system for dwellings.

Industry Impact

Understand how coastal erosion can impact property values and insurance premiums, so you can make the right decisions for your business today.