Executive Summary

A clear shift has been observed by CoreLogic across our valuation ordering platforms, pointing towards a gradual yet significant change in the proportion of valuation types used by lenders for residential mortgage security purposes. The findings showcase a tendency away from physical inspection valuations, towards digital, low-cost services. These digital avenues not only embody a streamlined and efficient approach but also boast economical attributes, underscoring a strategic migration in the industry's valuation methodology landscape.

This whitepaper provides pragmatic recommendations to navigate this changing landscape through a strategic valuation framework. It portrays; key principles, digital valuations, valuation type pros and cons, best practice rules set up, and valuation firm panel considerations. The paper also emphasizes effective data utilization and strategies to minimise wastage. Overall, it will equip lenders with insights to make informed decisions in the dynamic mortgage security valuation sector.

Background

Across our valuation ordering platforms, CoreLogic has observed a gradual change in the proportion of valuation types used by lenders for residential mortgage security purposes, away from physical inspection valuations, towards digital, low-cost services.

This change was initially driven by larger banks, but smaller and mid-size lenders are catching up, and in some instances have adopted even more aggressive strategies. A mid-size lender had an average valuation fee reduction of 19%, and an average turnaround time across all valuation types reduced of 47%, since mid-2022.

There are multiple reasons lenders are actively calibrating their valuation policy to use more AVMs and desktop assessments rather than physical inspection valuations:

- A better borrower experience with shorter approval times

- Reduced overall valuation costs

- Recent improvements in AVM accuracy through model improvements and better access to property data

- Increases in industry-approved value thresholds for desktop assessments – now increased to $2M (previously $1.5M)

Key Principles

The key principles to achieve a best practice framework for valuation ordering are below:

- Maximise digital valuations within a compliant risk mitigation framework

- Minimise wastage

- Ensure best practice use and re-use of data

These principles are the drivers behind the CoreLogic valuation eco-system and are considered throughout the process.

A Digital Valuation for Every Risk Profile

Every valuation type has its place in the ecosystem, aligned to the risk requirements of a particular loan application. AVMs and desktop assessments are the most commonly used digital valuation types, whilst kerbside assessments, residential short forms and residential long forms are the most commonly used traditional valuation types involving a physical inspection of the property.

In addition, CoreLogic now also offers a new digital valuation type, called SMARTval. SMARTval is a data-driven valuation solution without a physical inspection, which is backed by professional indemnity insurance, offering a similar risk profile to a physical inspection valuation, with the speed of a digital valuation. The SMARTval report is completed by a local, registered property valuer and is returned within 1 business day.

Traditionally, if a property had not been physically inspected, the valuation could not offer recourse, and was always considered to be a ‘no liability’ product, with the lender holding all the risk. However, with SMARTval, this is no longer the case, as this service is backed by professional indemnity insurance, bridging the gap between traditional and digital valuations.

Valuation Types

The table below outlines the main valuation types, with details relating to thresholds, risk factors, SLAs, and current ValEx splits:

Valuation Type | Channel | Value Limit | Recourse | Typical LVR Cut Off | Turnaround Time | Cost | ValEx Split |

|---|---|---|---|---|---|---|---|

AVM | Digital | By policy | No | 80% | Instant | $ | 25% |

Desktop | Digital | $2M | No | 90% | 0.5 days | $$ | 20% |

Kerbside | Traditional | By policy | No | 90% | 1-2 days | $$ | 7% |

SMARTval | Digital | $5M | Yes | 95% | 1.0 days | $$$ | <1% |

Short Form | Traditional | $5M | Yes | 100% | 3-4 days | $$$$ | 45% |

Long Form | Traditional | No limit | Yes | 100% | 7-10 days | $$$$$ | 2% |

NOTE: SMARTval is brand new and therefore the ValEx split is still very low – our modelling estimates that SMARTval could convert up to 40% of all residential short forms to SMARTvals, subject to policy settings.

Pros and Cons of Each Valuation Type

Valuation Type | Pros | Cons |

|---|---|---|

AVM |

|

|

Desktop |

|

|

Kerbside |

|

|

SMARTval |

|

|

Short Form |

|

|

Long Form |

|

|

Best Practice Rules Set Up

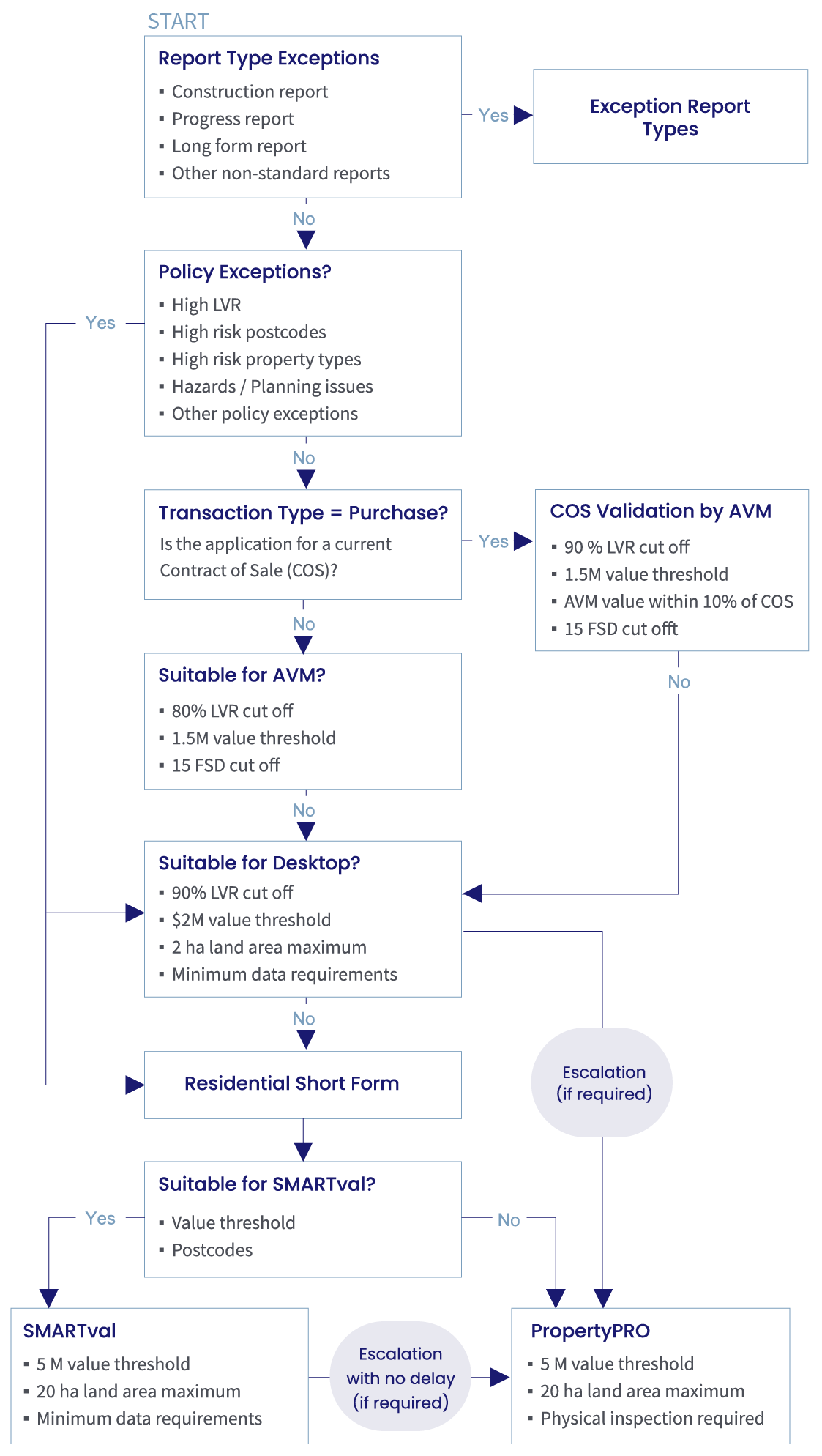

The 6 main variables for determining the valuation type are:

- Known risk or policy exceptions, i.e. planning risks, hazard risks, climate risks, concentration risks, report type exceptions (construction loan, progress payments, complex security), etc.

- Transaction type, i.e. purchase or a refinance

- Loan to value ratio (LVR)

- Value of property, based on the estimated market value (EMV) or contract of sale price (COS)

- Location, i.e. postcode, region or suburb

- Known risk factors or exceptions, i.e. planning risks, hazard risks, climate risks, concentration risks, report type exceptions (construction loan, progress payments, complex security), etc.

These variables are arranged as a cascade to determine the flow of the request. There is no ‘one-size-fits-all’ for rules, however, there are some general guidelines and industry norms which can be used to guide best practice.

Valuation Firm Panel Considerations

Secondary to the rules, are considerations for distribution to a panel of valuation firms. Panel distribution is generally based on the 4 following factors:

- Performance – Generally measured as turnaround times and compliance bounce rates

- Coverage – Refers to the locations serviced by a particular valuation firm

- Fees – The fees charged by a valuation firm

- Risk appetite – The risk appetite of the valuation firm to undertake specific valuation types for specific clients

In addition to the above, monitoring the accreditation and insurance status of the panel valuation firms is key to ensuring a compliant risk framework.

CoreLogic has a panel management service that can assist in selecting an optimal valuation firm panel for each valuation type and also the ongoing management and monitoring of all relevant industry accreditations and renewals.

Governance and Performance Monitoring

A strong governance framework and performance monitoring of all valuation types is essential to ensure compliance with standards and a strong operational base.

The following extract has been taken from Prudential Standard APS 220 Credit Risk Management, outlining an ADI’s obligations for monitoring of valuations:

"An ADI must have policies and processes directed at ensuring the reliability of the valuation processes and valuations received in respect of security held. This must involve independent and regular internal reviews of valuations and automated valuation methods results by appropriate management or audit personnel and formal reviews by an independent valuer."

There are generally 2 methods of compliance for valuations:

- In flight compliance – This compliance method is generally only used for full inspection valuations and checks compliance to relevant standards (not value), diverting live jobs for manual review before being delivered to the orderer (diversion is based on specific compliance rules and aims to capture approximately 3-5% of all full inspection reports)

- Hindsight reviews – This compliance method offers a deeper into a smaller sample of valuation reports to check compliance to standards as well as the valuation methodology, and is completed post-completion on a periodic basis for a random sample of reports, typically between 1-5% of all valuation service types

CoreLogic offers both in-flight and hindsight compliance services as part of our valuation service offering.In addition to these services, all of CoreLogic’s digital valuation services include performance monitoring reports, which benchmarks IntelliVal AVM, CoreLogic Desktops and SMARTval to accepted industry benchmarks, such as sale prices and full inspection valuations. Additional governance papers on these products are also available, if required.

Best Practice Use of Data

Underpinning the valuation ecosystem are multiple datasets to ensure a seamless cascade of digital valuations and escalation to a physical inspection valuation only if required. The main goal of a digital valuation is to eliminate the need for a physical inspection within a controlled risk mitigation framework, with property attribute data and imagery being the key enablers – greater availability of data and imagery improves both the potential to order a digital valuation and the accuracy of the outcome.

The 2 main sources of data powering the digital valuation ecosystem are:

- CoreLogic’s attribute data

- Valuations data captured from completed physical inspection valuations

CoreLogic attribute data is the most commonly used dataset, and has been powering AVMs and desktop assessments for years. However, more recently, CoreLogic has created a new ecosystem with a technical framework to ‘recycle’ valuation data into our digital valuation services, ensuring no valuation data goes to waste.

This data-enabled ecosystem is made possible due to CoreLogic’s end-to-end management of valuation ordering and our suite of proprietary digital valuation services.

Minimising Wastage

One of the biggest considerations for lenders in the current lending environment is the minimisation of wastage within the valuation ecosystem. Waste can take any of the following forms:

- Valuations being reordered due to undesirable outcomes

- Escalations to higher valuation types by valuers

- Unnecessary processes adding time and costs

- Poor reuse of available data

Tackling all the above requires a multi-faceted approach throughout the entire process, with a focus on:

- Optimal rules setup to proactively escalate requests to higher valuation types if required and ensure best practice use of digital valuation types to eliminate unnecessary physical inspections

- Best practice use of data to ensure both CoreLogic’s attribute data and physical inspection data are being leveraged to their maximum capability within the IntelliVal, CoreLogic Desktop and SMARTval products

- Timely reporting and feedback loops with valuers to drive performance and reduce unfavourable behaviours

CoreLogic can offer a range of tools to ensure best practice implementation and monitoring to ensure optimal performance and minimal wastage, including rule simulations, panel management and live reporting dashboards to monitor business and panel performance factors.

"When customers are looking for a home loan or looking to refinance, a fast decision is critical to provide certainty and confidence and help them get into a property or get their loan sorted".

NAB’s Executive, Home Ownership, Andy Kerr

Next Steps

In a highly competitive market, lenders need to provide certainty to customers as early as possible. The need to drive efficiencies as well as improve on SLAs across the entire valuation framework has become paramount. Your valuation strategy plays an important role in achieving these goals, ultimately driving a faster time to yes, helping you grow your customer base.

This whitepaper provided guidelines on how to optimise your valuation strategy. However, we understand that every lender has its own business intricacies and risk appetite. If you would like a customised review of your valuation strategy, reach out to your CoreLogic Account Director or complete the form below and we will be in touch with you.