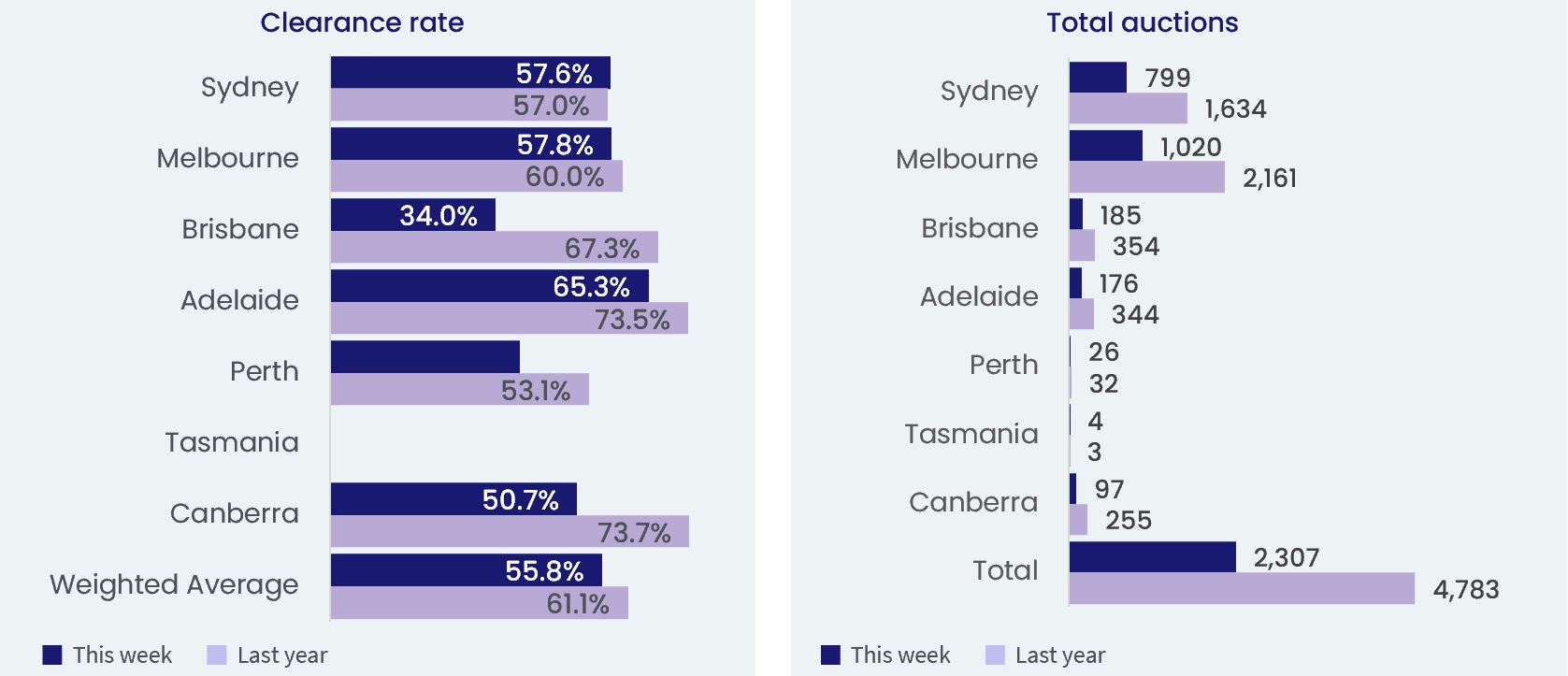

After hosting the busiest auction week since late May the week prior, capital city auction activity softened this week, ahead of the festive period's seasonal slowdown, with 2,307 homes auctioned across the combined capitals.

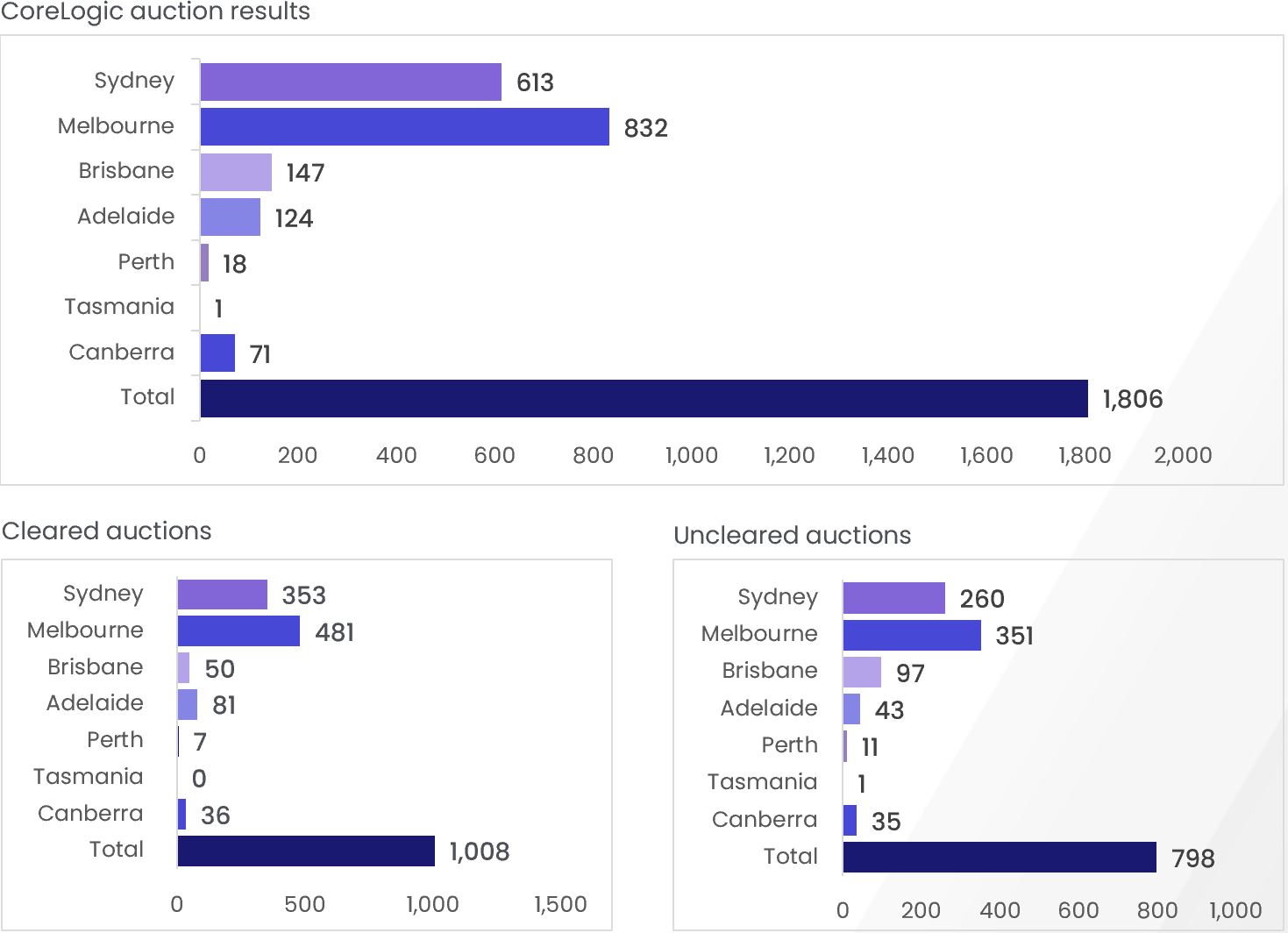

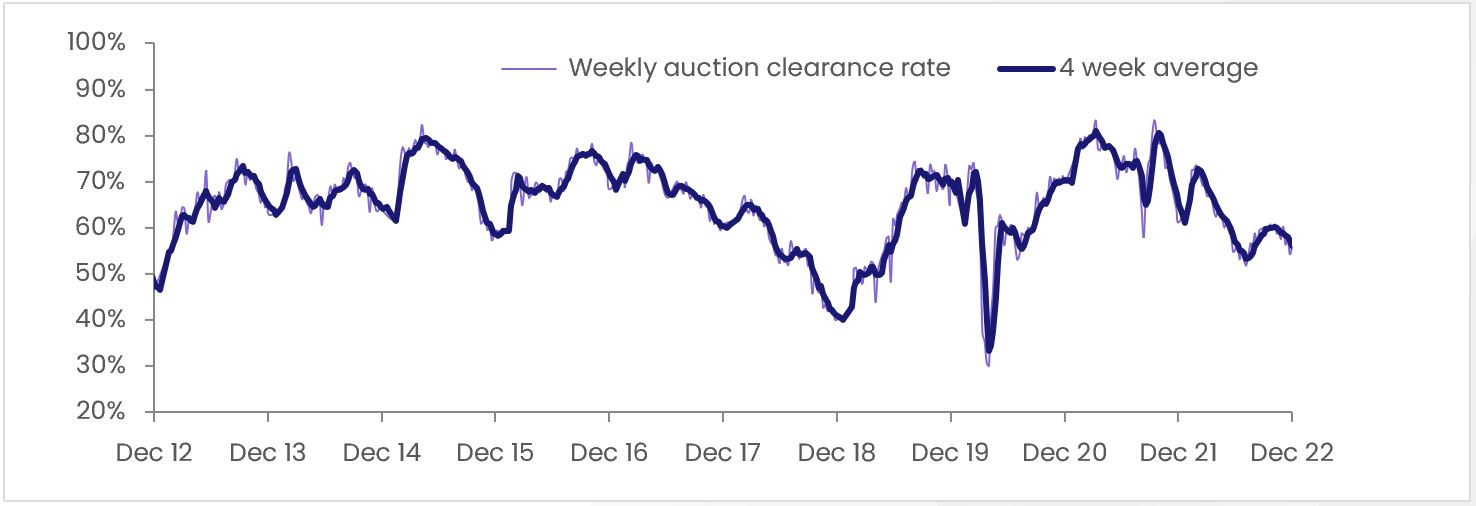

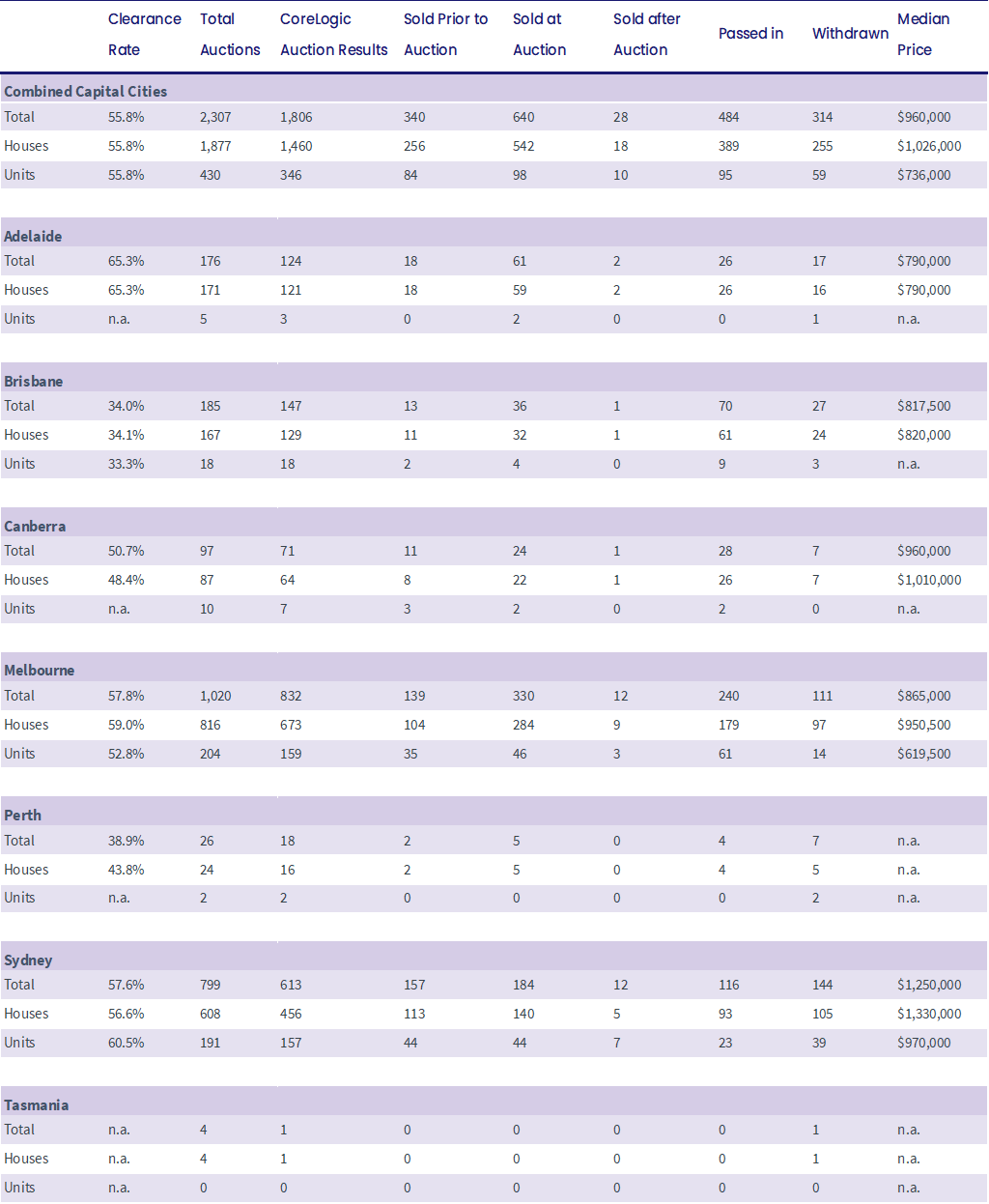

This week's auction activity was -15.1% below the 2,717 auctions held the previous week, and less than half the number of auctions held this week last year (4,783), when the combined capitals (driven by Sydney and Melbourne) recorded the second busiest auction week since CoreLogic records commenced. With 55.8% of the 1,806 results collected so far reporting a successful result, the combined capital's preliminary clearance rate fell 2.1 percentage points this week to the weakest preliminary result since early July (55.0%). A preliminary clearance rate of 57.9% was recorded the previous week, revised to 54.3% at final figures, while this time last year, 61.1% of auctions were successful.

Capital City Auction Statistics (Preliminary)

Despite falling -16.8% week-on-week, Melbourne auction activity held above 1,000 for the fifth consecutive week, with 1,020 homes taken to auction across the city this week. The previous week saw 1,226 homes auctioned, while more than double the number of homes went under the hammer this week last year (2,162). Of the 832 results collected so far, 57.8% were successful — Melbourne's lowest preliminary clearance rate since late July (57.0%). Last week's preliminary clearance rate of 59.4% (revised to 56.0% at final numbers) was 1.6 percentage points higher, while 60.0% of the 2,161 auctions held this week last year reported a successful result.

Weekly clearance rate, combined capital cities

Across Sydney, 799 homes went under the hammer this week, down -17.1% from the 964 auctions held last week. With 613 results collected so far, this week's preliminary clearance rate (57.6%) overtook the previous week's result of 58.5% (revised down to 55.4% at final figures) as Sydney's lowest preliminary clearance rate since late August (56.9%). The 90 basis point decline saw Sydney's withdrawal rate rise to 23.5%, its highest rate since mid-July (24.7%). This time last year, 1,634 homes were taken to auction across the city, and a clearance rate of 57.0% was reported.

Capital City Auction Statistics (Preliminary)

Across the smaller capitals, Brisbane recorded the busiest auction week, up 2.8%, with 185 homes auctioned across the city. This was followed by Adelaide (176) and Canberra (97), down -7.9% and -31.7%, respectively. At 65.3%, Adelaide's preliminary clearance rate continued to be the strongest among the smaller capitals, despite falling 20 basis points from the last week's preliminary result (65.5%). In Canberra, 50.7% of auctions returned a successful result, while Brisbane recorded its lowest preliminary clearance rate of the year at 34.0%. In Perth, seven of the eighteen results collected so far returned a successful result, while the one result reported across Tasmania so far was unsuccessful.

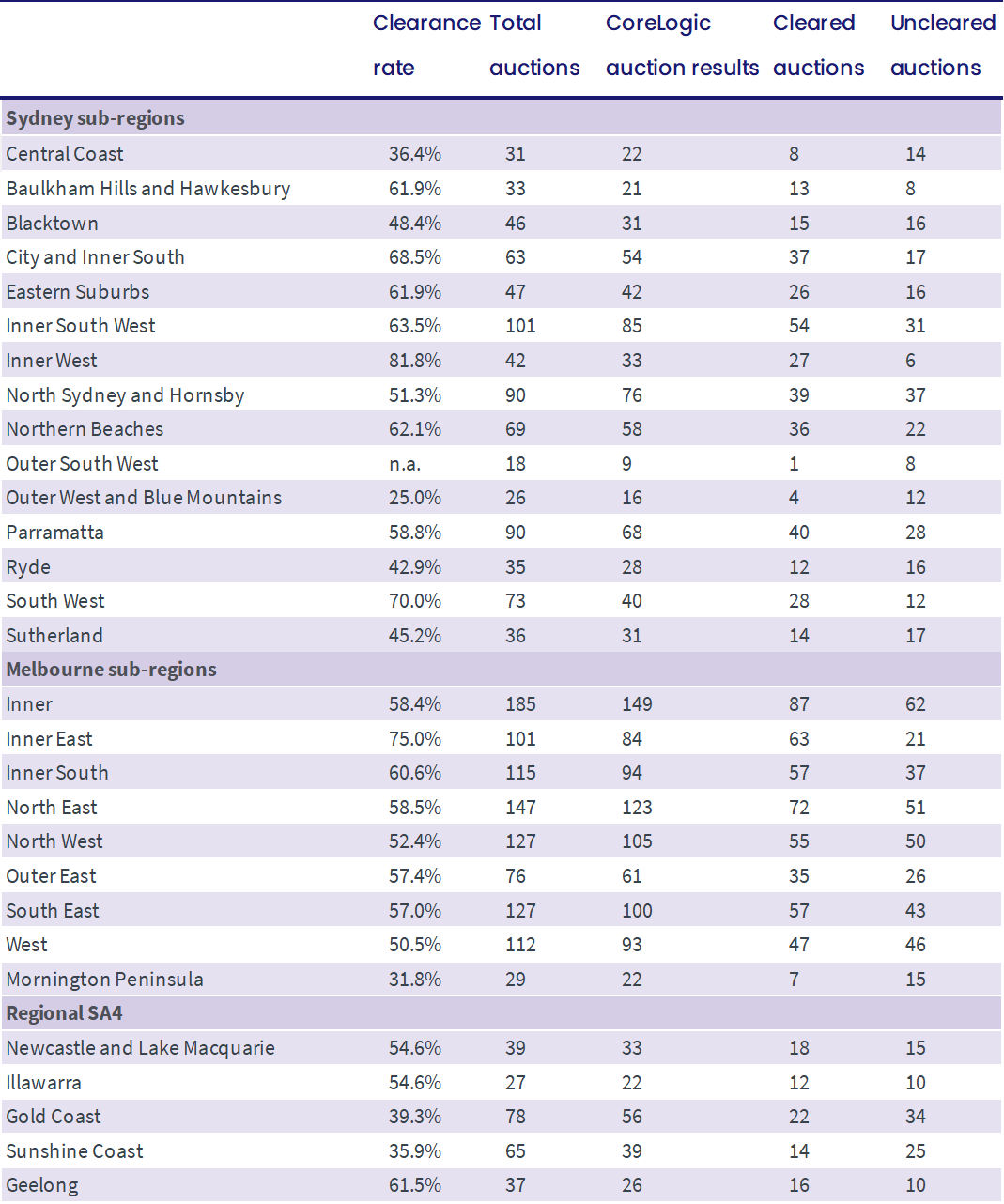

Sub-region auction statistics (preliminary)

Including this week's preliminary numbers, 103,898 capital city auctions have been held over the 2022 year. While this is -14.9% below the record 122,091 auctions held last year, this year's capital city auction activity is still 10.8% above the annual average number of auctions held over the previous five years.

Note: This is the final weekend market summary for 2022. Auction reporting will resume in late Jan/early Feb, depending on volumes.