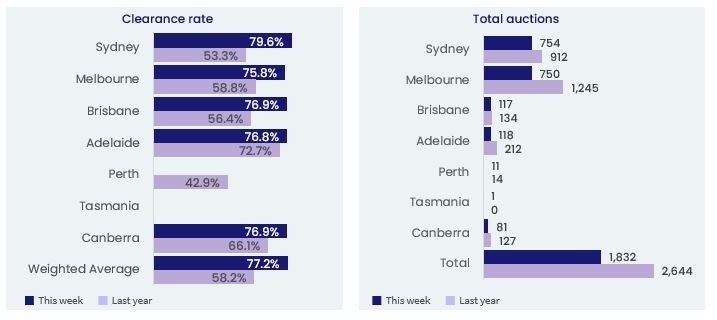

The start of winter saw capital city auction activity fall -2.9% this week, with 1,832 homes auctioned across the combined capitals.

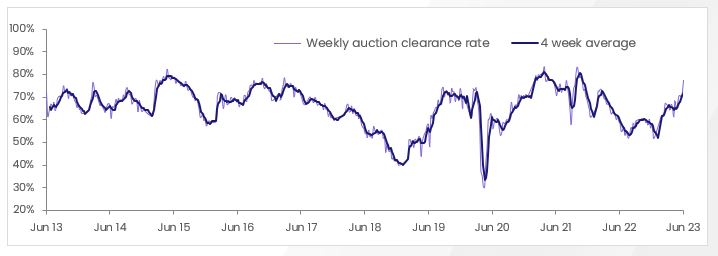

The previous week saw 1,887 homes go under the hammer, while this time last year, 2,644 auctions were held. The combined capital's preliminary clearance rate trended higher for the third consecutive week, overtaking the week prior as the highest preliminary clearance rate of the year to date and the highest rate since late October 2021 (78.9%). Of the 1,440 results collected so far, 77.2% reported a successful result. Last week's preliminary clearance rate was -1.3 percentage points lower at 75.9% (revised to 71.5% at final numbers), while this time last year, a clearance rate of 58.2% was reported.

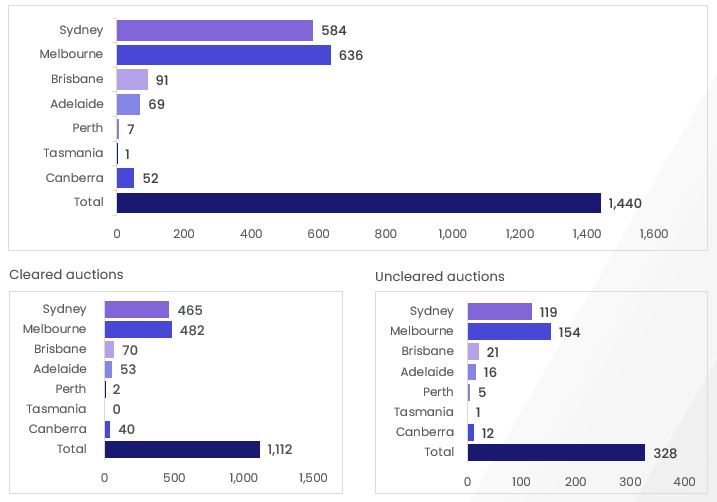

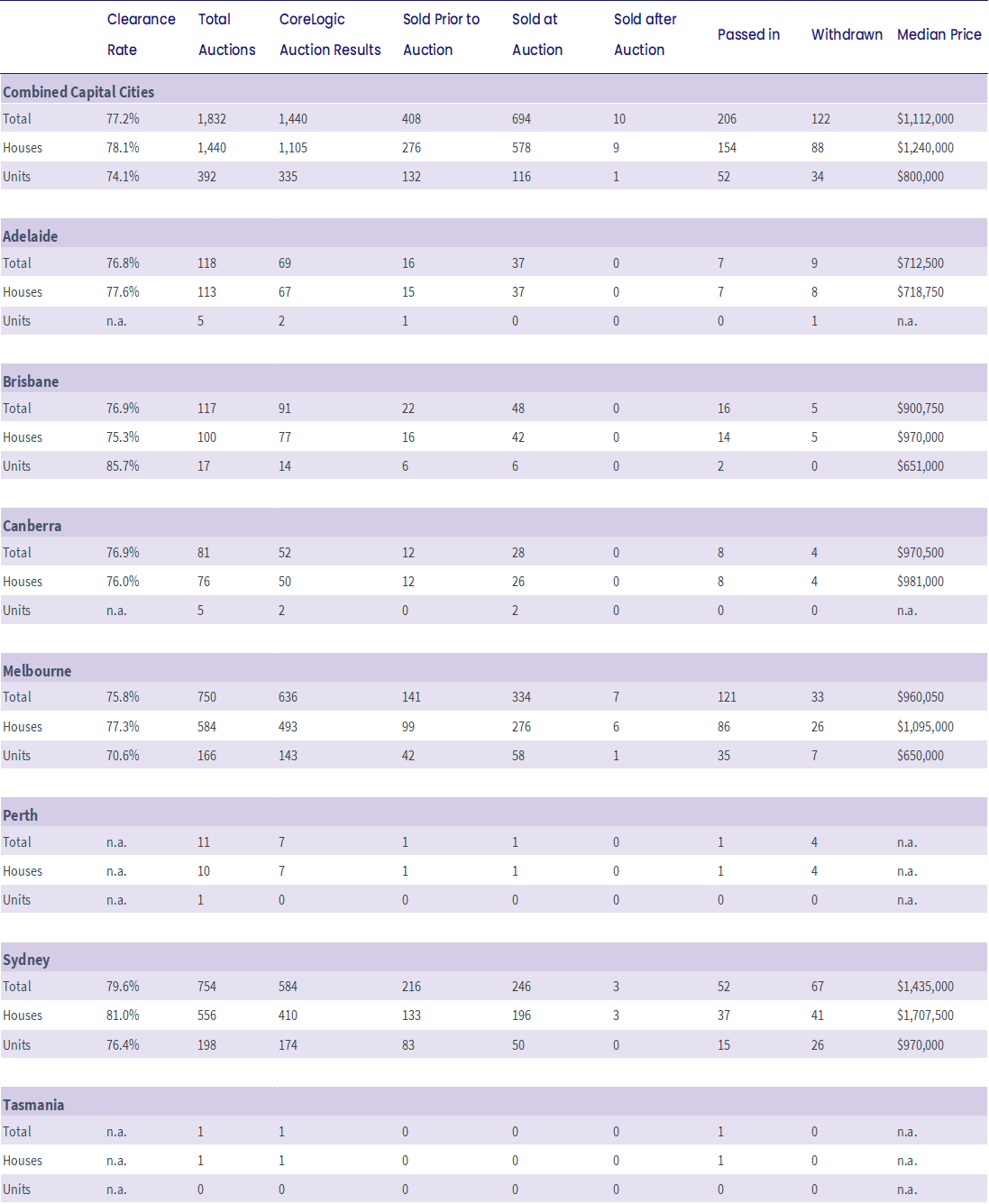

Capital City Auction Statistics (Preliminary)

Across Melbourne, 750 homes went under the hammer this week, down -11.1% from the 844 held last week. With 636 results collected so far, Melbourne's preliminary clearance rate fell -1.3 percentage points from 77.1% last week (revised to 71.7% at final figures) to 75.8% this week. Despite the fall, this week marks Melbourne's eighth consecutive week with a preliminary clearance rate above 70%. This time last year, 58.8% of the 1,245 homes auctioned across Melbourne were successful.

Sydney was the busiest auction market this week, with 754 homes auctioned across the city. Compared to the previous week (698), this week's auction activity was up 8.0% but was -17.3% below the 912 auctions held this time last year. With 79.6% of the 584 results collected so far recording a positive outcome, this week's preliminary clearance rate is tied with the week ending 13th February 2022 (79.6%) as the city's strongest since mid-October 2021 (80.8%). The continued uptick in the clearance rate is being driven by buyer demand, with the portion of properties passed in at auction (8.9%) falling to its lowest rate since mid-October 2021 (8.0%), while the withdrawal rate rose slightly to 11.5%. The previous week's preliminary clearance rate of 78.5% was -1.1 percentage points lower, while this time last year, just 53.3% of Sydney auctions were successful.

Capital City Auction Statistics (Preliminary)

Across the smaller capitals, action activity rose in Canberra (81), fell in Brisbane (117) and held steady across Adelaide (118) week-on-week. Brisbane recorded its highest preliminary rate since mid-February 2022 (80.7%), with 76.9% of auctions reporting a successful result. Canberra also recorded a preliminary clearance rate of 76.9%, up 9.1 percentage points week-on-week, while Adelaide's preliminary clearance rate fell -5.0 percentage points to 76.8%. In Perth, just two of the seven results collected so far have returned a successful result, while no auctions were held in Tasmania this week.

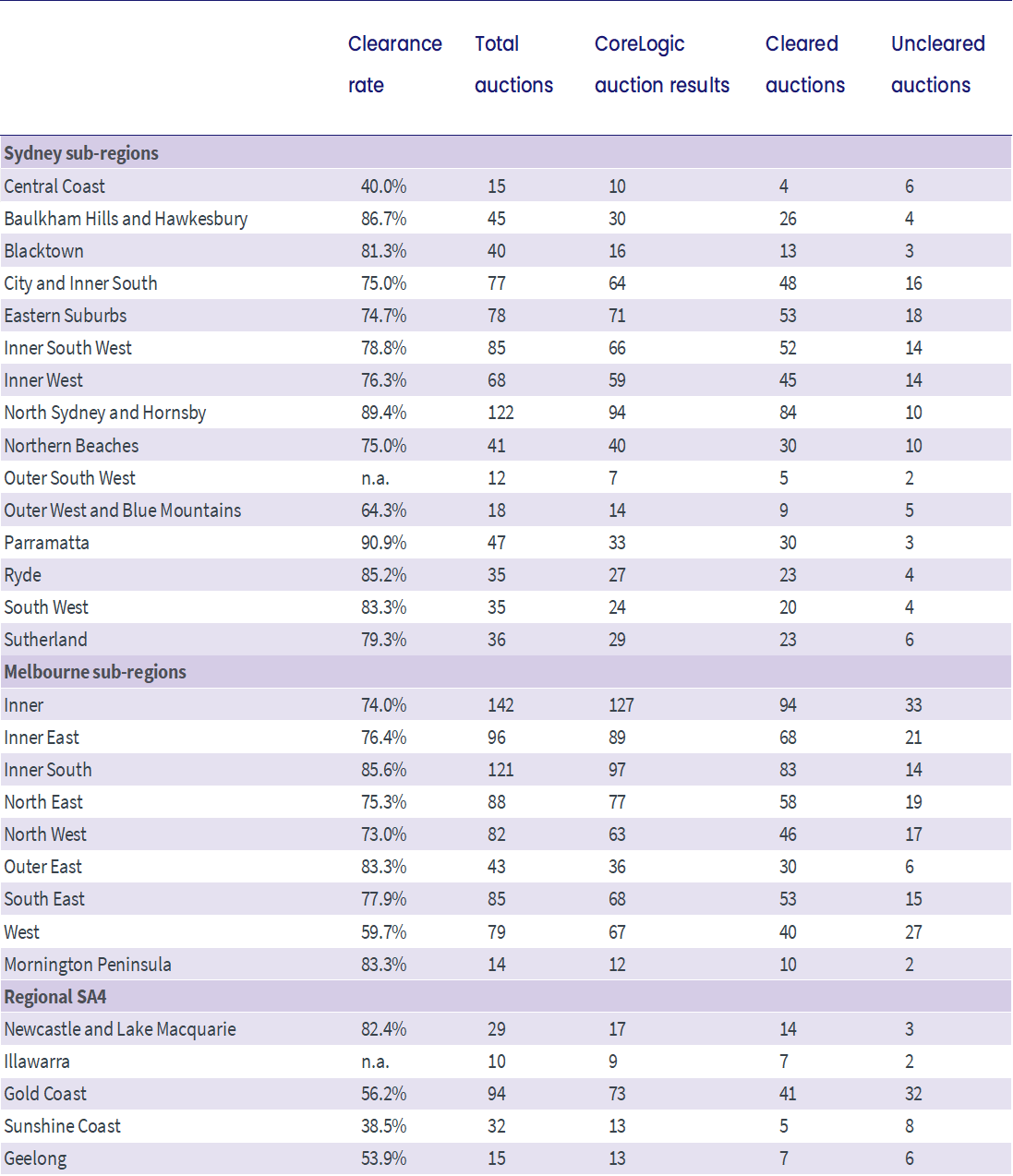

Sub-region auction statistics (preliminary)

Capital city auction activity is expected to ease next week before rebounding the following week, with six of the eight states and territories celebrating the King's birthday long weekend next Monday.

Download Property Market Indicator Summary