Australian rent values have increased 24.1% between the start of an upswing in September 2020, through to February 2023. On the surface it would appears to be the perfect storm for property investors.

The pace of monthly rent increases is accelerating, the monthly vacancy rate nationally slipped back to 1.0% in February, and the count of rental listings on the market sank to around 96,000 over the past four weeks, down from a previous five-year average for this time of year of 150,000.

So, if rental income is rising and there is no shortage of potential tenants, why are investors shying away from the real estate market?

Investment purchases are declining

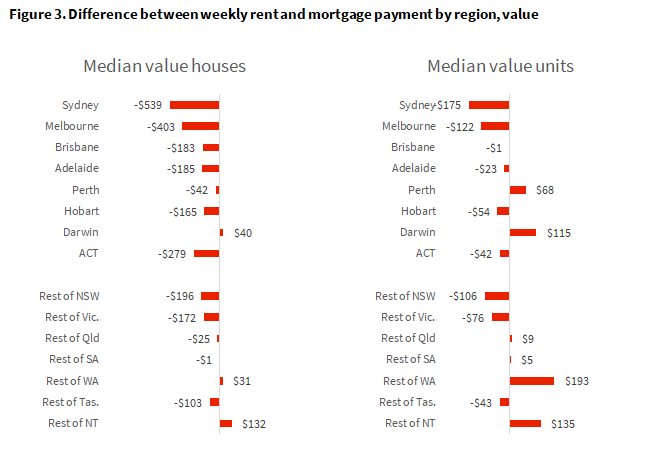

The number of investors buying dwellings has been falling since early 2022. Figure 1 shows the monthly number of loans secured for investment property purchases, which peaked at 21,663 in March 2022. As of January 2023, the volume of new investment loans had fallen around 47% to 11,485. The decline to January is compounded by a seasonal drop in sales, but the downward trend since March suggests waning investor interest in Australian real estate.

Rents rose at a record pace, but mortgage costs rose faster

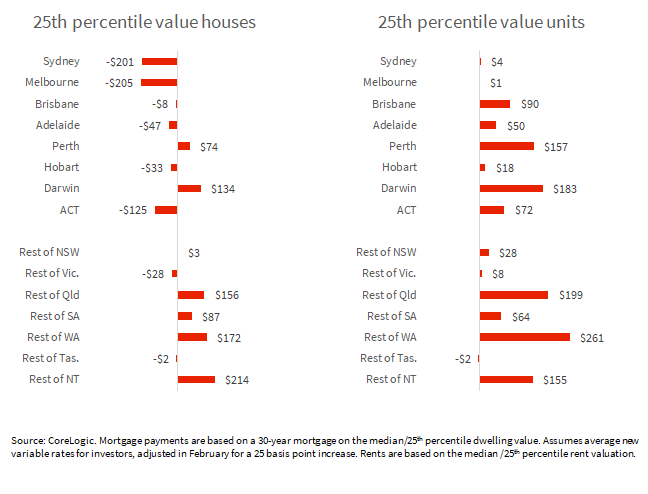

Since the start of a rental upswing in September 2020, mortgage payments for new investment mortgages have, on average, increased faster than rents.

Using Australia’s median dwelling value and rent as an example, weekly rent values have gone from $455 to $564 between September 2020 and February 2023. Weekly payments on a variable-rate investment loan on the median dwelling value rose from $443 to $738 per week (Figure 2). In this scenario, the difference between weekly rent and a new investment mortgage repayment has gone from $11 at September 2020, to -$174 by February 2023. On average, mortgage costs have risen much faster than rent values due to a record hike in the underlying cash rate, and dwelling values still being relatively high relative to where they were in September 2020.

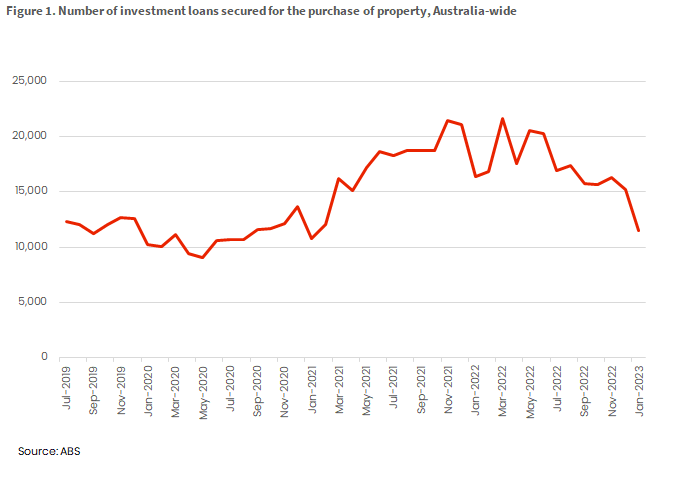

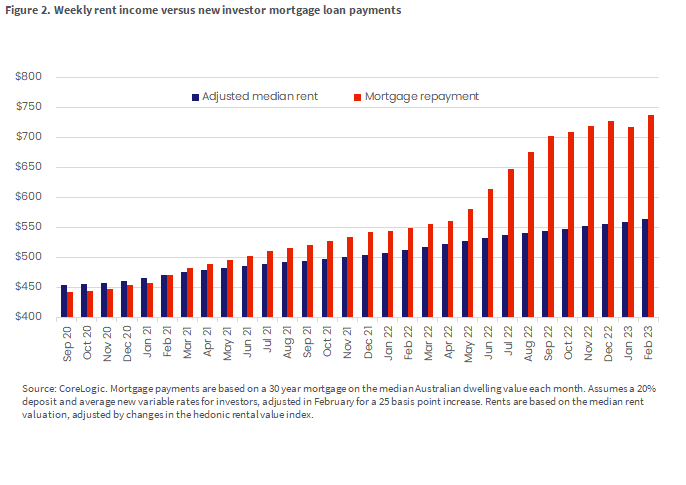

Figure 3 shows what the current difference would be between a weekly gross rent income and a weekly investor mortgage payment. These scenarios are presented for the median value in each region, as well as the 25th percentile valuation (a low home value). This is because investors generally target a lower-priced segment of the market, which tend to have greater yields.

Aside from resource-based markets (Perth and Darwin and parts of regional Australia), the value of mortgage repayments largely exceeds gross rental income as of 2023 for these price points. Even where there are marginal gains such as $4 per week at the 25th percentile unit value, this is only based on a gross estimate of rental income, and does not take into account maintenance, management fees or other additional costs associated with purchasing and owning an investment property.

Capital growth incentive is not what it used to be

Having high rent that exceeds mortgage costs is not the only reason investors take interest in property. In the 2019-20 financial year, ATO data suggests 53.7% of investment properties made a net rent loss. Negative gearing exists to help investors purchase real estate and provide rental housing when operational costs of the property exceed rental income.

In return however, investors expect capital gains. In the current environment opportunities for capital gains have been diminished by factors such as high interest rates and low consumer confidence. By the end of February 2023, Australian dwellings had seen a record fall of -9.1%.

Beyond the current market downswing, the RBA has flagged a broader shift in the Australian economy from the post-GFC era, in which low inflation and interest rates is less certain than it once was. This may mean that capital growth in Australian home values over the next decade may not replicate the 57% gains seen in the past ten years.

There are other changes to investment purchases over time that may have exacerbated the drop-off in investment purchases, and compounded losses on investment properties. These include a higher premium on mortgage rates relative to over-occupiers, changes to depreciation benefits in 2017, and greater protections and rights for renters through updates to tenancy law. It is worth noting however, that these longer-term changes to investment ownership over time did not dissuade an investment boom while interest rates were low. According to the ABS housing lending series going back to July 2002, investors secured a record $11.4 billion for the purchase of property in March last year.

Implications for renters

The reduction in new investment purchases exacerbates the issue of low rental supply and rising rents. As the proposition of individually-owned investment property in the market becomes less attractive, Australians need a new source of investment in rental accommodation.

This should at least in part be in the form of more social housing (or more funding for social and community housing providers), where increases in rent values tend to create the most vulnerability and insecurity across lower income households. This vacuum in the provision of rental accommodation has also seen more attention to the Build-to-Rent sector, which relies more on long-term rental income than capital gains. Greater accommodation of Build-to-Rent has already been seen in NSW, where the government announced a land tax discount to make these projects more viable.