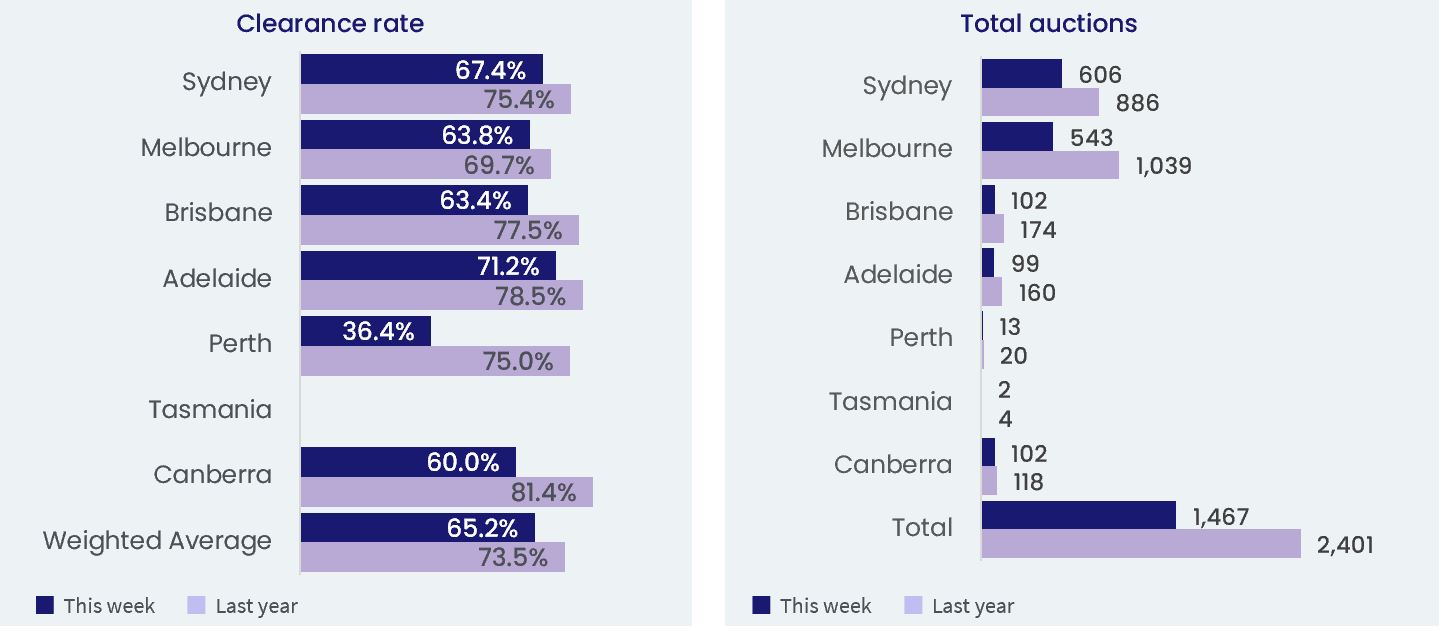

Across the combined capitals, auction activity continued to ramp up this week, with 1,467 capital city auctions held, up 11.0% from the 1,322 held last week.

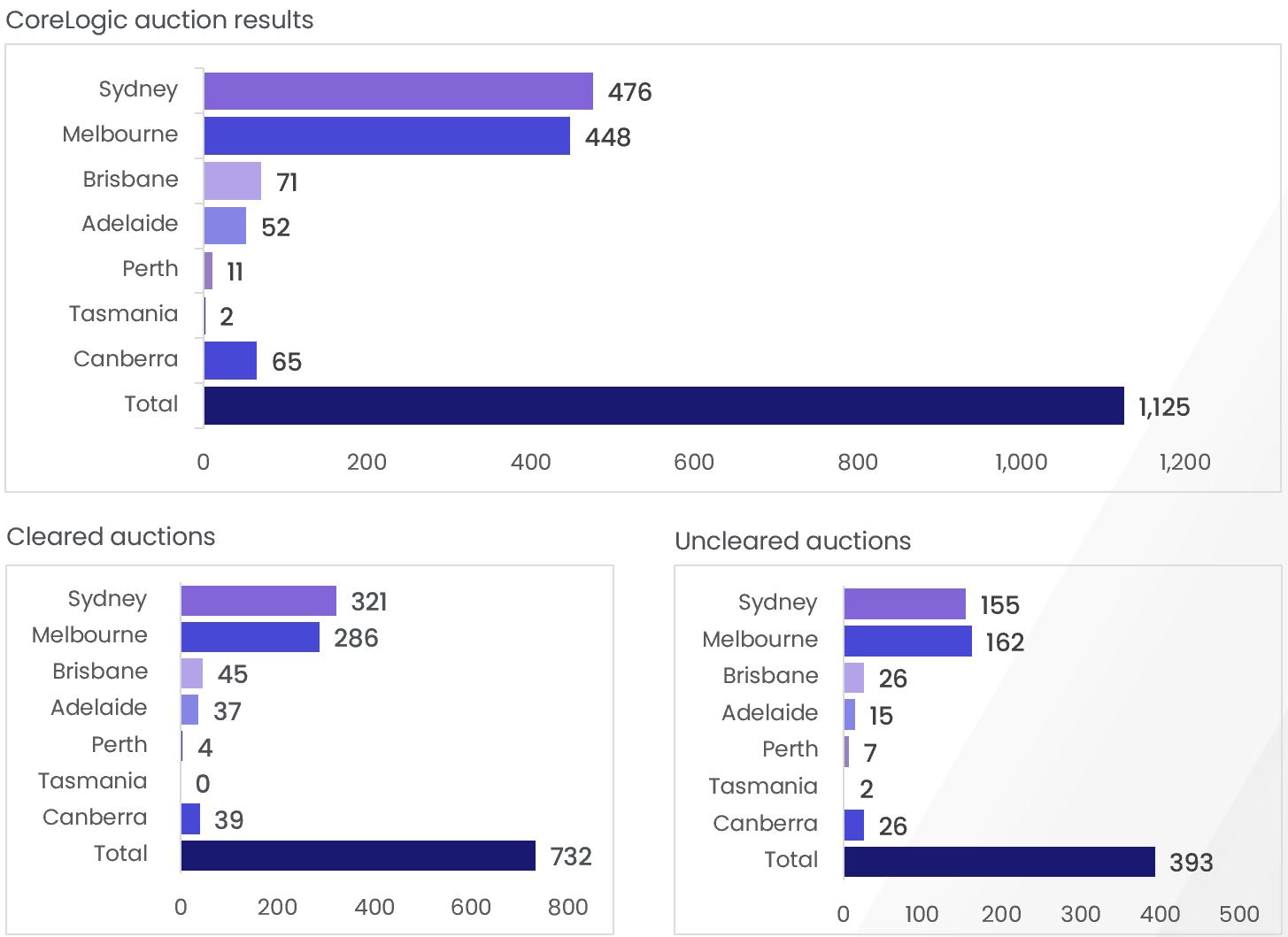

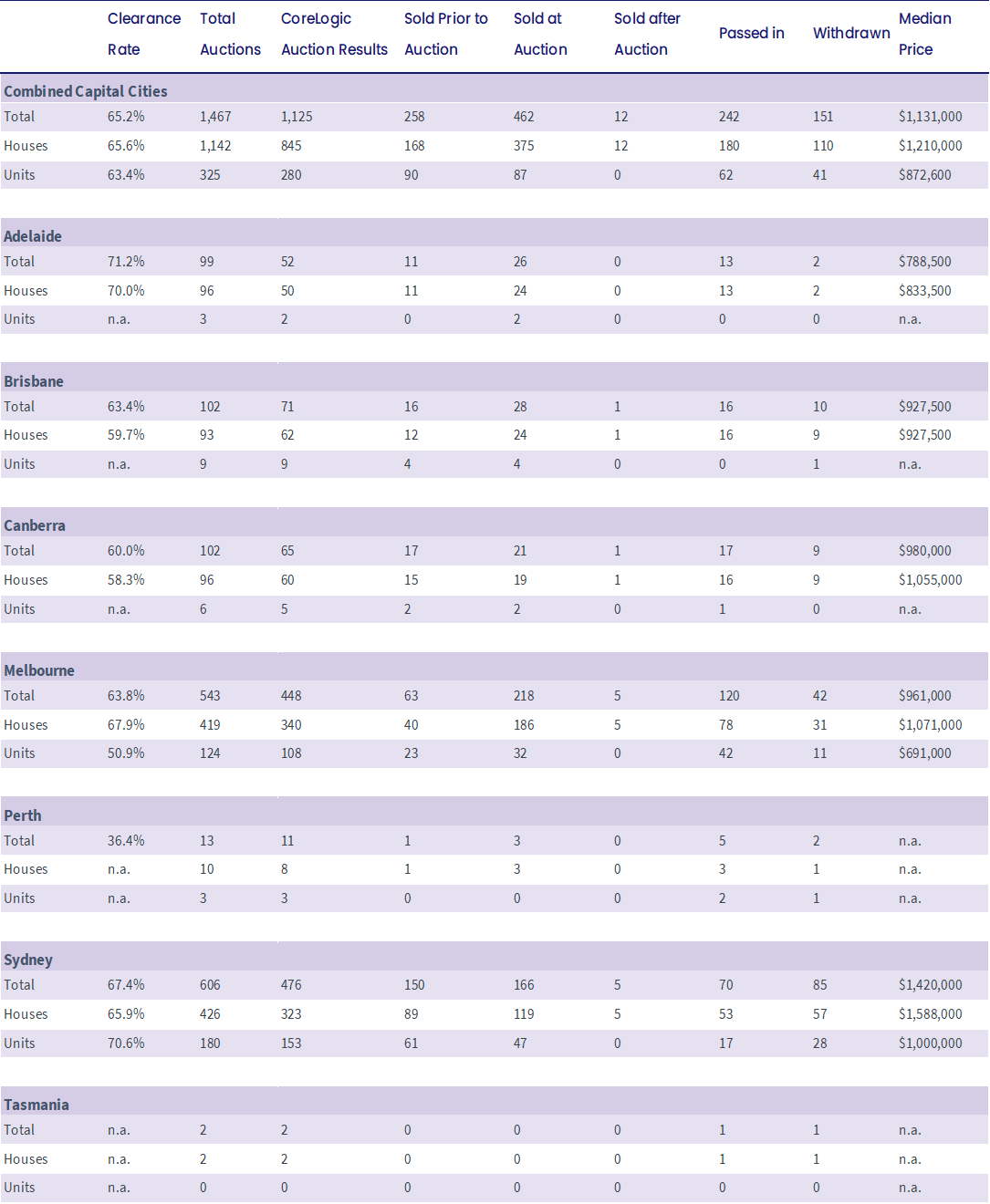

With the 1,125 results collected so far, the combined capital's preliminary clearance rate fell -2.2 percentage points, with 65.2% recording a successful result. Weaker auction results were recorded across most of the capitals, with only Brisbane recording a week-on-week increase in its preliminary clearance rate.

Capital City Auction Statistics (Preliminary)

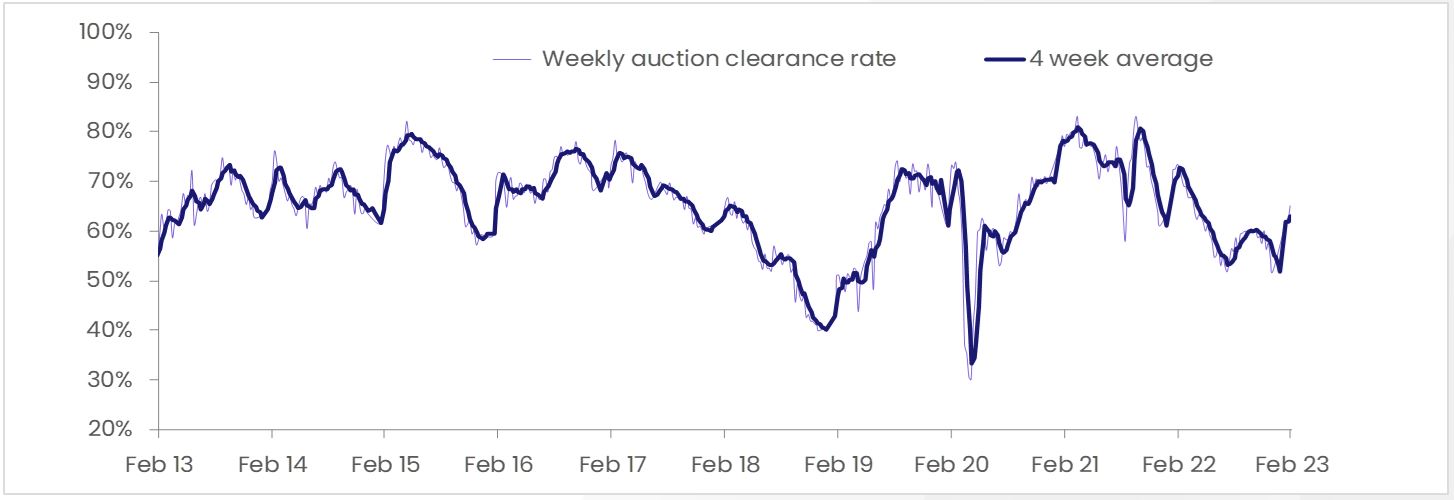

While below last week's preliminary clearance rate of 67.4% (revised down to 61.9% at final numbers), this week's result is still significantly higher than the average preliminary rate recorded in December (58.5%). This time last year, 2,401 homes were taken to auction across the city, and a final clearance rate of 73.5% was reported.

Weekly clearance rate, combined capital cities

An increase in the withdrawal rate, from 9.3% to 13.4%, this week could signal a worsening in vendor confidence following the more pessimistic inflation outlook and expectation for further rate hikes from the RBA. Once final figures are reported, it's likely we'll also see a rise in the portion of properties passed in at auction. As we navigate an uncertain interest rate environment, clearance rates and auction activity will continue to be an important marker for both buyer and vendor confidence. With just shy of 2,000 capital city auctions expected, next week will provide a timely test of market demand.

Sydney hosted the busiest auction market this week, with 606 homes auctioned across the city. The previous week saw 424 homes go under the hammer, while this time last year, 886 auctions were held. At 67.4%, with 476 results collected so far, Sydney's preliminary clearance rate fell below 70% for the first time this year, down -3.2 percentage points from last week's preliminary rate of 70.6% (revised to 65.6% at final numbers). The dip in Sydney's clearance rate was accompanied by a rise in the withdrawal rate, from 12.5% last week to 17.9%. This time last year, 75.4% of auctions held across Sydney reported a successful result.

Across Melbourne, 543 homes went under the hammer this week, up 31.5% from the 413 auctions held last week but down -47.7% from the number of auctions held this time last year (1,039). Melbourne's preliminary clearance rate continued to trend lower this week, with 63.8% of the 448 results collected so far returning a successful result. Last week's preliminary clearance rate was 3.3 percentage points higher at 67.1% (revised to 64.6% at final figures), while this time last year, 69.7% of reported auctions were successful.

Capital City Auction Statistics (Preliminary)

Auction activity across the smaller capitals cooled this week, with the volume of auctions falling by -34.4% week on week. Brisbane and Canberra both hosted 102 auctions, down -49.0% and -27.1%, respectively, compared to last week's numbers, while Adelaide saw 99 homes taken to auction this week (-23.8%). Brisbane was the only capital to record a rise in its preliminary clearance rate, up 11.5 percentage points to 63.4%. Adelaide recorded a preliminary clearance rate of 71.2%, while 60.0% of auctions held in Canberra recorded a successful result. In Perth, four of the 11 results collected so far returned a successful result, while the two auctions held in Tasmania this week were unsuccessful.

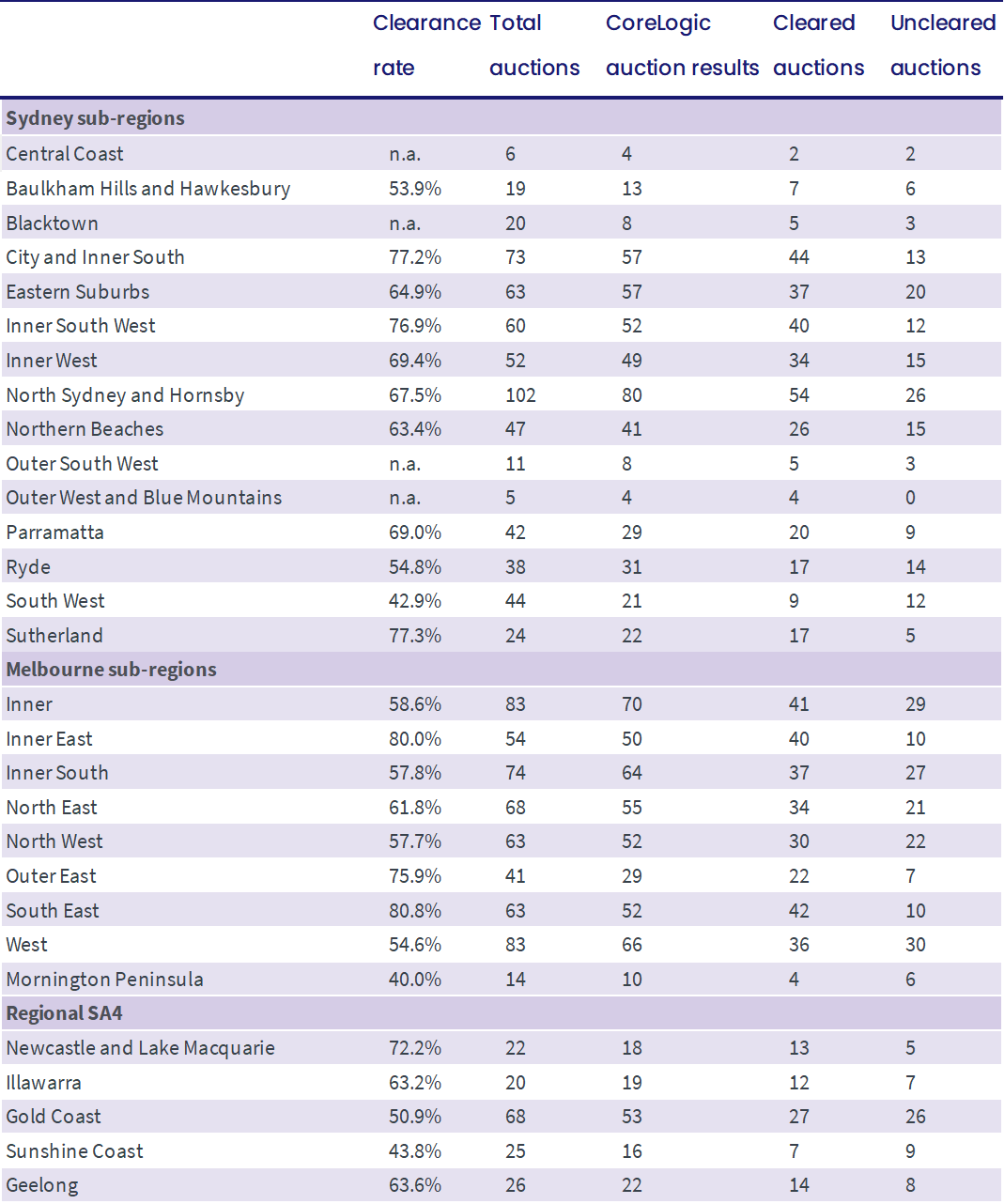

Sub-region auction statistics (preliminary)