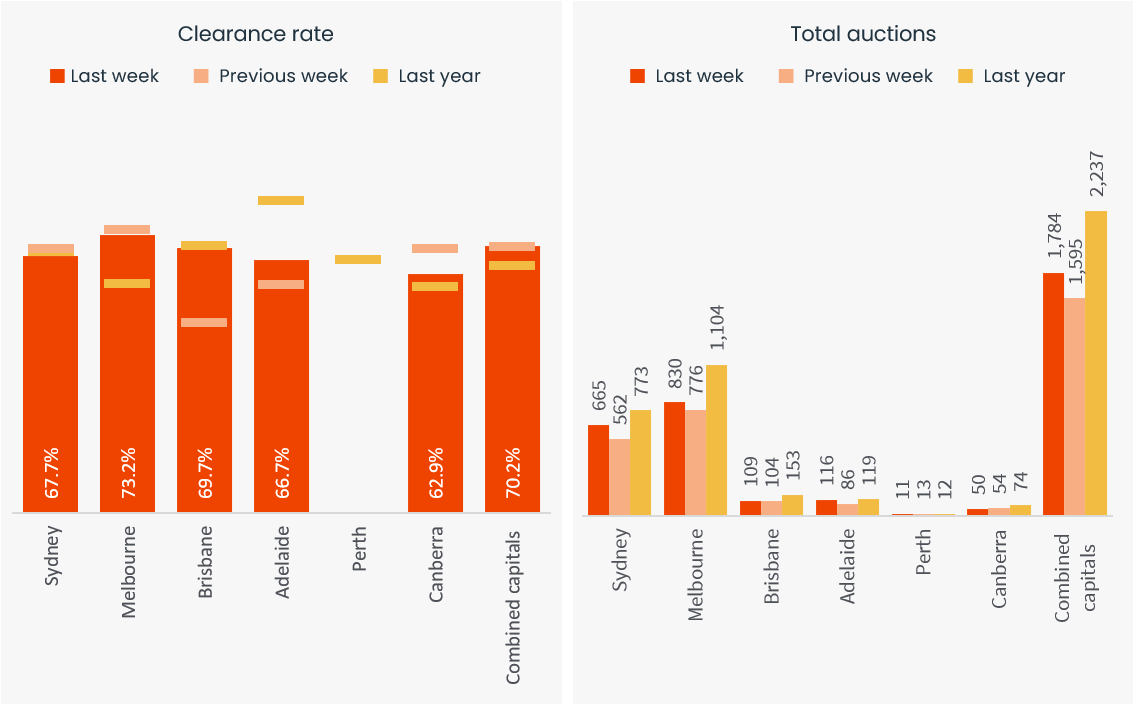

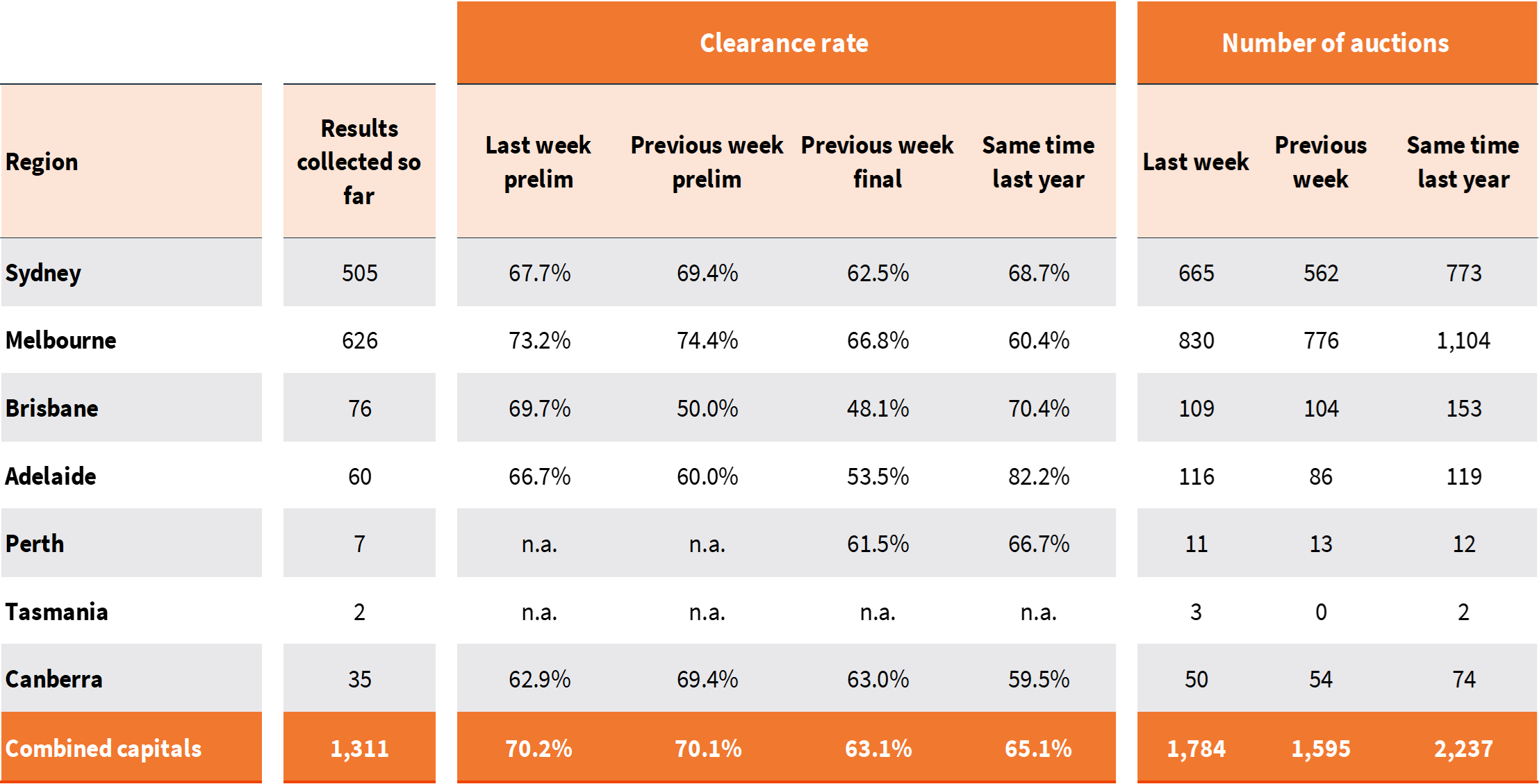

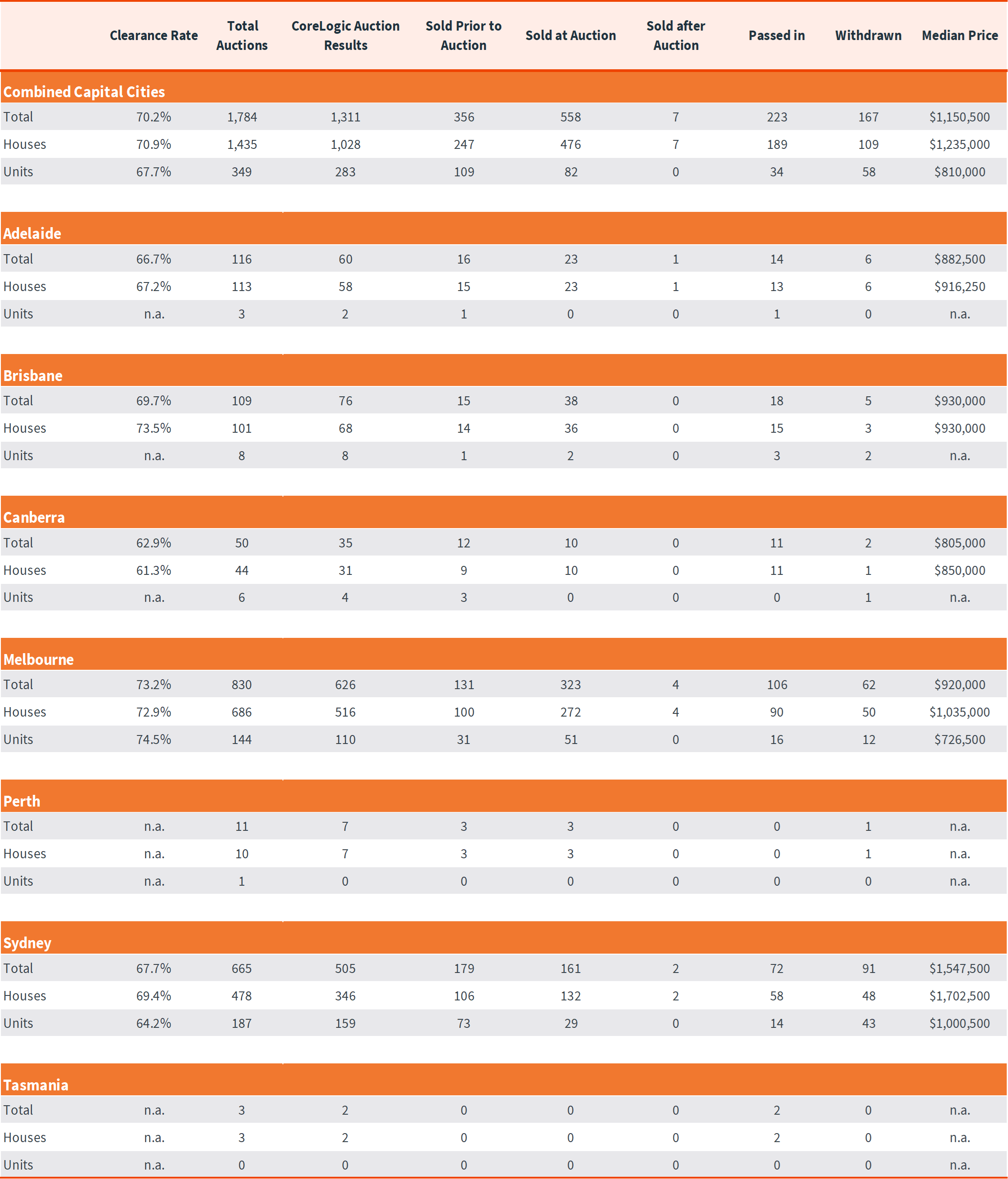

1,784 capital city auctions were held last week, the highest volume of auction events since the week prior to Easter, when 3,066 homes went under the hammer. The number of auctions was up 11.8% on the week prior but continued to hold well below the levels seen a year ago (-20.3%) when housing conditions were much stronger.

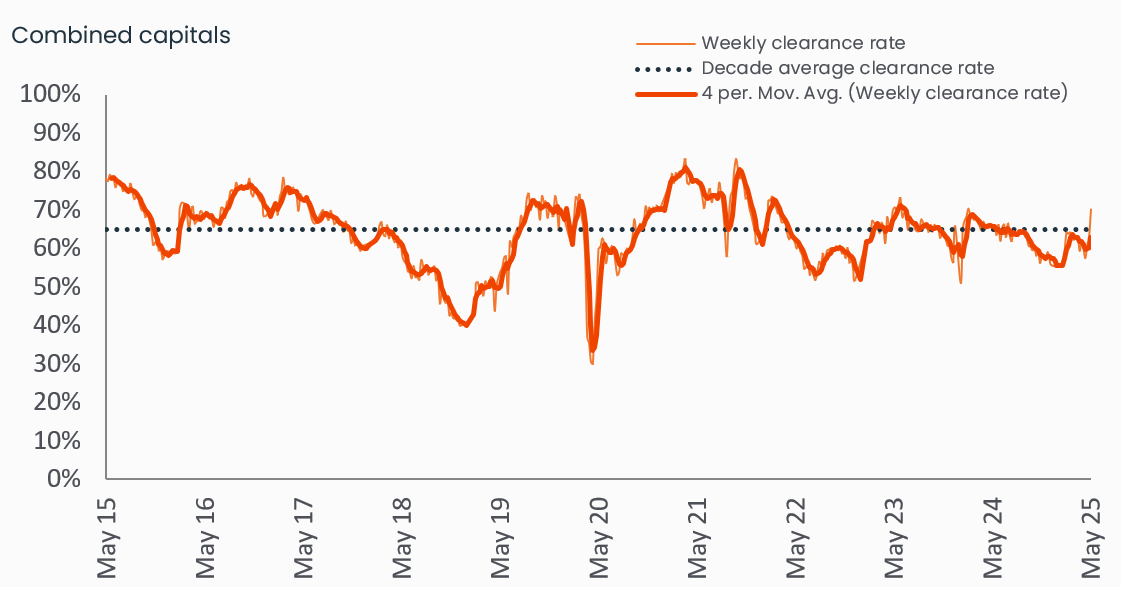

The preliminary auction clearance rate held above the 70% mark for the second week running. At 70.2%, last week’s result was roughly in line with the prior week when a preliminary clearance rate of 70.1% (revised down to 63.1% once finalised) was recorded.

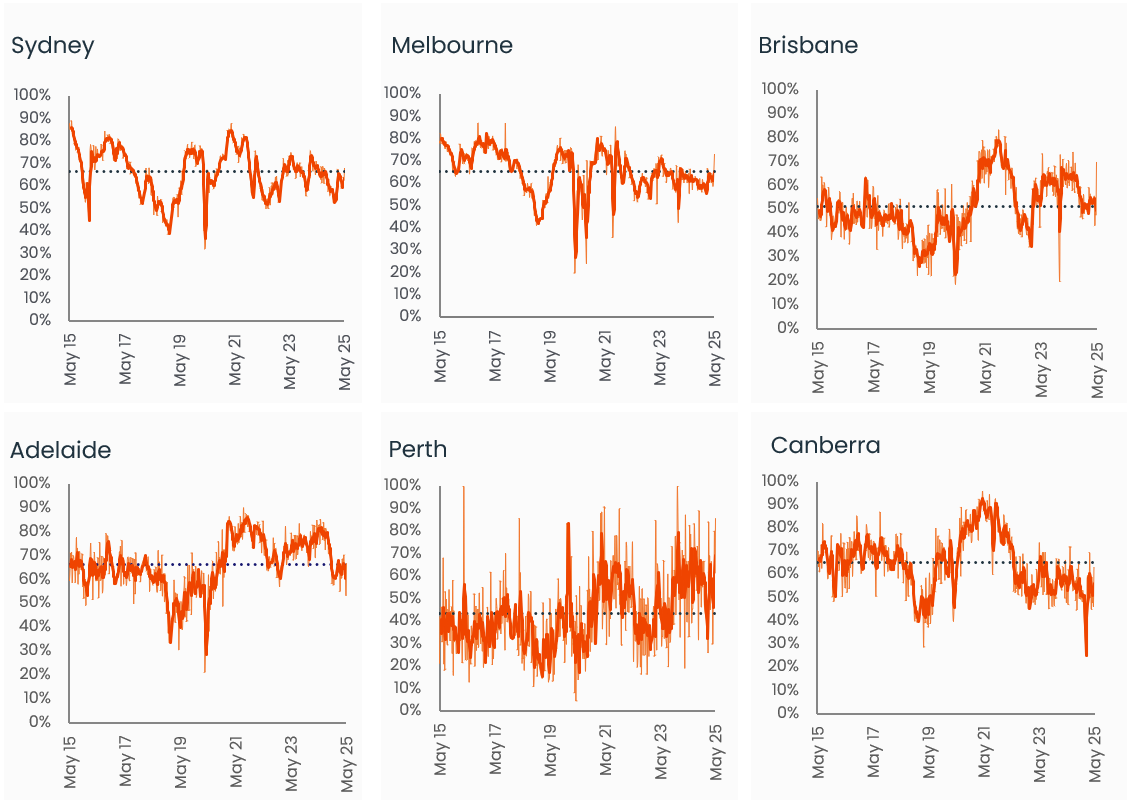

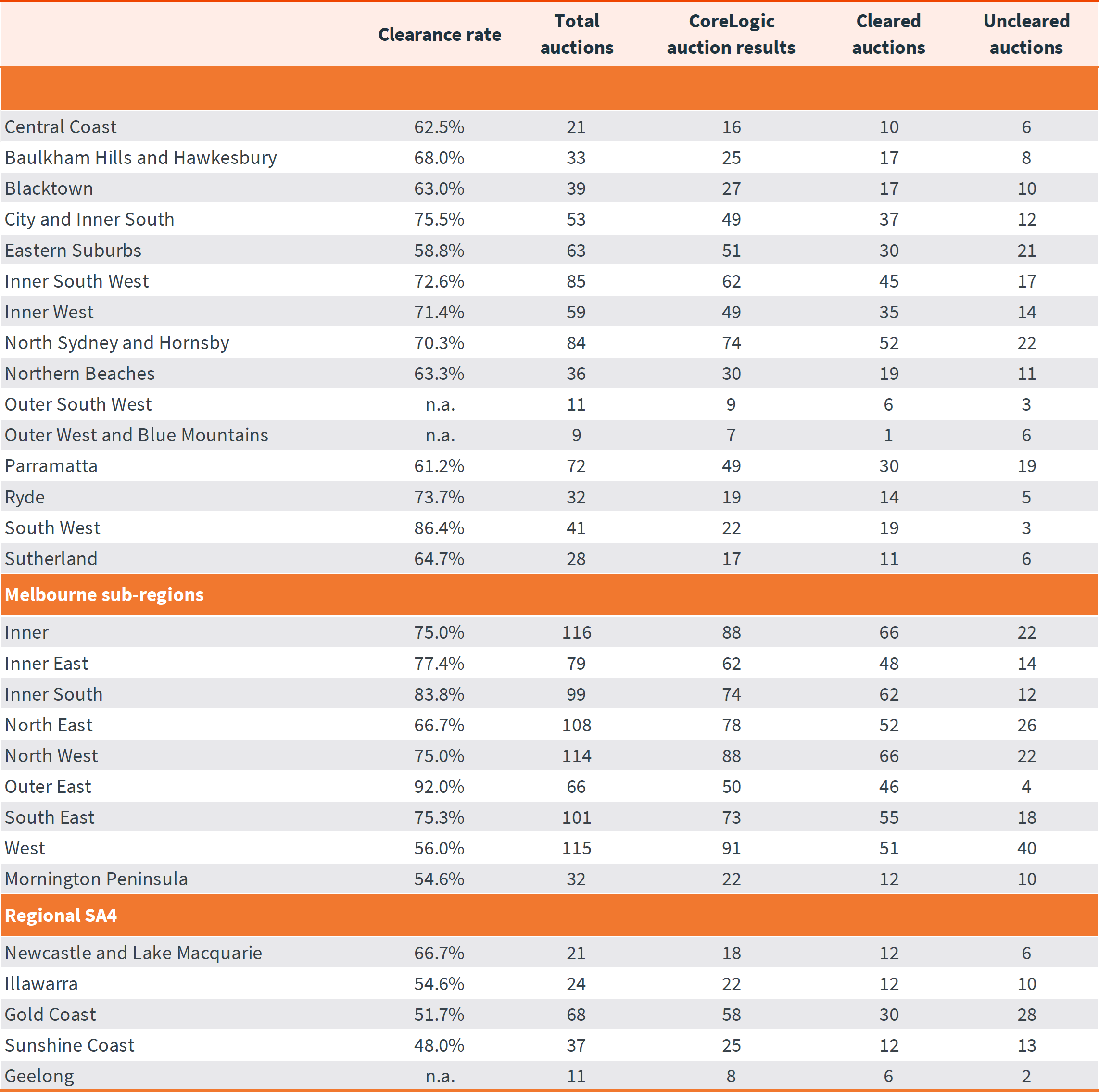

830 auctions were held in Melbourne, up from 776 the week prior. While the early clearance rate slipped a little, from 74.4% the previous week to 73.2%, last week’s result was still the city’s second highest preliminary clearance rate so far this year.

Historical clearance rates utilise the final auction clearance rate, while the current week is based on the preliminary clearance rate.

Sydney hosted 665 auctions, up from 562 the week prior. The preliminary clearance rate has held below the 70% mark for the eighth consecutive week with 67.7% of the results collected so far returning a positive result, down from 69.4% the week prior.

Adelaide held the highest volume of auctions across the smaller capitals, with 116 homes taken under the hammer. Based on results reported so far, 66.7% of homes auctioned have sold, up from 60.0% the week prior and the city’s highest result in three weeks.

109 homes were auctioned in Brisbane, up from 104 the previous week, returning a preliminary clearance rate of 69.7%, the highest since August last year.

The above results are preliminary, with ‘final’ auction clearance rates published each Thursday. CoreLogic, on average, collects 99% of auction results each week. Clearance rates are calculated across properties that have been taken to auction over the past week.

Only 50 homes went to auction across the ACT last week, down from 54 the week prior and returning a preliminary clearance rate of 62.9%, down from 69.4% the week prior.

In Perth, six of the seven auction results reported so far were successful, while the two auction results collected in Tasmania were both unsuccessful.

CoreLogic, on average, collects 99% of auction results each week. Clearance rates are calculated across properties that have been taken to auction over the past week.

This week is likely to see around 1,600 auctions go to market, before rising to around 2,200 next week.

Download Property Market Indicator Summary