Featured news

See all

Article

Research News; Auction Market Preview

Auction Market Preview - 28 April 2024

Auction volumes steady for fourth consecutive week

Article

Research News, Auction Market Preview

Auction Market Preview - 21 April 2024 Auction Market Preview - 21 April 2024

Reports

See all

Report

Product News; Thought Leadership

e-book: Social media advertising

In the real estate market, where attention equates to success, the shift towards online advertising has become non-negotiable for high-performing agents.More agents are leveraging digital platforms as they recognise the power of...

Report

Thought Leadership

Pain & Gain Report Pain & Gain Report

Report

Commercial Pulse

Cordell Construction Monthly Report Cordell Construction Monthly Report

Report

Women and Property, Research News, Thought Leadership

Women and Property 2024 Women and Property 2024

Product News

See all

Article

Property Pulse; Product News; Research News

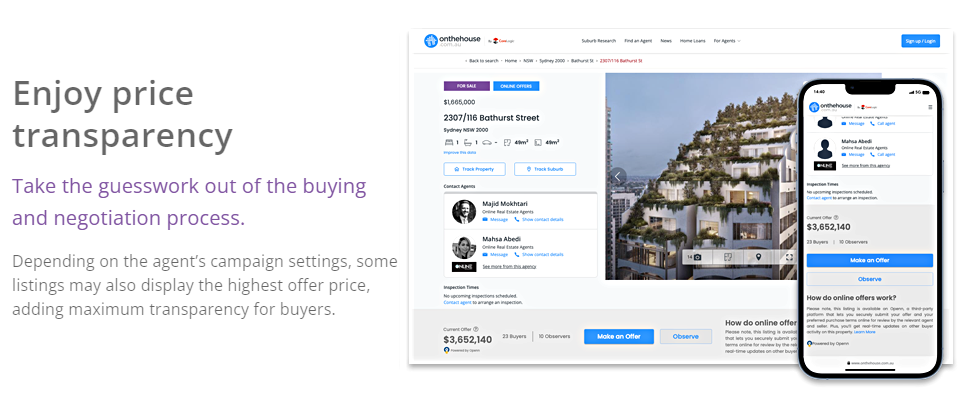

Can price transparency create better results?

Article

Product News, Thought Leadership